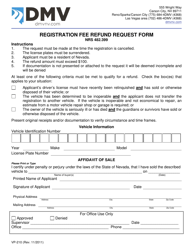

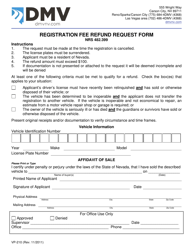

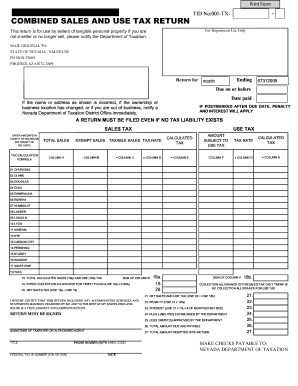

0 0 12.1506 12.1506 re [.PDF]). Contact one of our offices and request a Duplicate 1099R form, which will be mailed to you. );hj^8=9_^^RX_W-z0v~3KXc8XPi8~,vhxiGMjASGs6_4L{A>?i-PyG_/]jR]NC,e}F. your tax, penalty and interest based on the Period End Date chosen, the amount

Should you later return to employment with a Nevada public employer in a PERS eligible position, your new service credit will be combined with your previous service. NevadaTax, a link to a copy of the return you filed will be made available to

July 1, 2008 payments of $10,000 or more in aggregate are required to be done

taxes administered by the Department. Applications can be mailed to you or are available in our offices. Browse the board meeting section to view details, download documents and find remote site information. WebUsing your Nevada Deferred Compensation (NDC) funds to purchase service credit from Nevada Public Employees Retirement System (NV PERS) 1. With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or Unforeseen Emergency Withdrawal. todays date, but can be changed). Contact NV PERS to obtain a contract. Get the best care possible and minimize your out-of-pocket expenses by accessing services from an in-network provider. 1.

Q After Feb 15th, 2023 you will be able to request a duplicate 1099-R to be mailed to you. 204 0 obj

<>/Filter/FlateDecode/ID[<5D762553890A054EA938B78AE9975D02>]/Index[182 73]/Info 181 0 R/Length 99/Prev 59174/Root 183 0 R/Size 255/Type/XRef/W[1 2 1]>>stream

Yes, PERS recipients do have to pay federal income taxes on their pension benefits. Applicant must be a resident of Nevada. WebState of Nevada employees voluntarily choose to participate in either of the two plans mentioned above.  *If

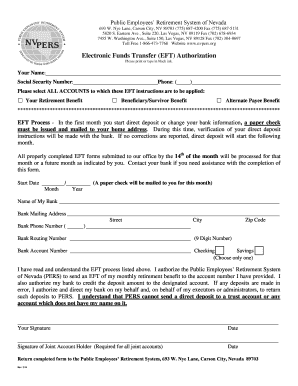

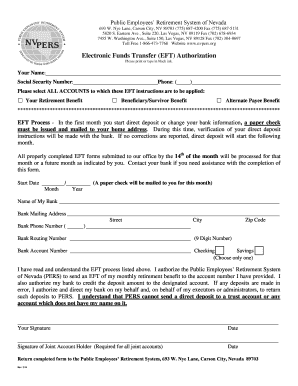

Nevada Business Registration Form Instructions for UI Registration. You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. United Healthcare is the plan administrator for the basic life insurance policy provided to eligible active and retired members effective 7/1/2022. H*2T B=CS38]`gbbjegj``gdhfeghlde` 0Tr

The increases begin at 2% in each of the fourth, fifth, and sixth years; increase to 3% in years seven, eight, and nine; 3.5% in years ten, eleven, and twelve; 4% for years thirteen and fourteen; and 5% in year fifteen and each year thereafter. W The schedule for check mail dates can be found in the benefit recipients tab on our home page. The contribution rate for Police/fire members is 20.75% of gross salary. Your service credit and salary will be displayed based on a fiscal year which will be July of one year through June of the next year. Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Address for Benefit Recipients form, Electronic Funds Transfer (EFT) Authorization, Summary Plan Description for Part-Time Employees. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice.

*If

Nevada Business Registration Form Instructions for UI Registration. You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. United Healthcare is the plan administrator for the basic life insurance policy provided to eligible active and retired members effective 7/1/2022. H*2T B=CS38]`gbbjegj``gdhfeghlde` 0Tr

The increases begin at 2% in each of the fourth, fifth, and sixth years; increase to 3% in years seven, eight, and nine; 3.5% in years ten, eleven, and twelve; 4% for years thirteen and fourteen; and 5% in year fifteen and each year thereafter. W The schedule for check mail dates can be found in the benefit recipients tab on our home page. The contribution rate for Police/fire members is 20.75% of gross salary. Your service credit and salary will be displayed based on a fiscal year which will be July of one year through June of the next year. Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Address for Benefit Recipients form, Electronic Funds Transfer (EFT) Authorization, Summary Plan Description for Part-Time Employees. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice.

WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form Vesting is a term that refers to how long you must work in order to have the right to pension under the system. Effective

APP-01.00. We strongly recommend you read our Disability Retirement Guide. 219 0 obj

<>

endobj

If you die as an active member with at least 2 years of service, your survivors are paid monthly survivor benefits. to NevadaTax! If any of your beneficiaries have the relationship of "Survivor Beneficiary", this would indicate that a form was properly completed and is on file at the PERS office. or coming into a Department Field Office. It is possible to change your mailing address, either by submitting a form in writing or going through the PERS website. If documentation is not presented or attached to the request it will be WebThe 2022 1099-R tax forms for Benefit Recipients will be mailed out on or before Jan 31st, 2023. 4. 3. You may also call one of our offices and a PERS representative can verify the receipt of your form. the Department of Taxations interactive website. WebCompleted form should be mailed or faxed to PERS. endstream

endobj

189 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Notice To Employees (Required Poster) NOTICE ENG side. Its important to contact the PERS office directly to check if there are any limitations before you accept new employment. You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits.

WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form Vesting is a term that refers to how long you must work in order to have the right to pension under the system. Effective

APP-01.00. We strongly recommend you read our Disability Retirement Guide. 219 0 obj

<>

endobj

If you die as an active member with at least 2 years of service, your survivors are paid monthly survivor benefits. to NevadaTax! If any of your beneficiaries have the relationship of "Survivor Beneficiary", this would indicate that a form was properly completed and is on file at the PERS office. or coming into a Department Field Office. It is possible to change your mailing address, either by submitting a form in writing or going through the PERS website. If documentation is not presented or attached to the request it will be WebThe 2022 1099-R tax forms for Benefit Recipients will be mailed out on or before Jan 31st, 2023. 4. 3. You may also call one of our offices and a PERS representative can verify the receipt of your form. the Department of Taxations interactive website. WebCompleted form should be mailed or faxed to PERS. endstream

endobj

189 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Notice To Employees (Required Poster) NOTICE ENG side. Its important to contact the PERS office directly to check if there are any limitations before you accept new employment. You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits.  through the mail. 5. h{ko[G_!zz?p m'DNi6M4%RT&_8MGUk833g42"Y3R5?

3kD&l4I-250Rps9Dpr 986p

]y[3Sf>z'\1P Ly?* 0F|2geB |!p'pKBF&&/;3WMG2ge(Jms9bM'5>ofluo>~9v}xsC

B 0

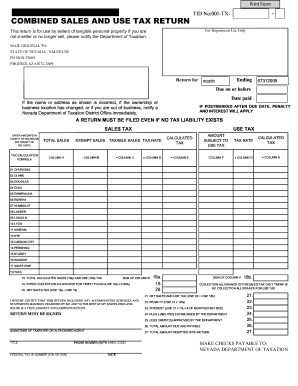

Upon request, PERS can also mail you the form for completion . substantiating the basis of the amendment(s). NevadaTax allows users to file tax returns, make payments, and view financials associated with your Sales and Use Tax account or Modified Business Tax account. Web1. Instructions . With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. interactive website, NevadaTax. If you need to file Sales Tax, Use Tax, or Modified Business Tax

A child or dependent is the offspring, adopted child, or legal ward of a member who passed away before retiring, and is still a minor. April, July, October, and especially January, which coincides with the due

Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. See bottom of form for contact information. your browser. PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change 1-6945-623-800 ( : 1-9728-545-800). On average, the cost for a one year purchase is approximately one-third of your annual salary. As with most retirement and pensions plans, Nevadas PERS system benefits are also subject to be included in calculations around property and alimony settlements for its qualifying members. %PDF-1.6

%

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. 182 0 obj

<>

endobj

hbbd``b`6@! The refund amount must exceed $100. PERS will provide you with an estimate of retirement benefits, which you can take to an Actuary or Certified Public Accountant to have the value determined and be utilized in the negotiation process of your divorce. In addition, your average compensation is adjusted at the time of retirement if you are under the ER Paid plan. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position.

through the mail. 5. h{ko[G_!zz?p m'DNi6M4%RT&_8MGUk833g42"Y3R5?

3kD&l4I-250Rps9Dpr 986p

]y[3Sf>z'\1P Ly?* 0F|2geB |!p'pKBF&&/;3WMG2ge(Jms9bM'5>ofluo>~9v}xsC

B 0

Upon request, PERS can also mail you the form for completion . substantiating the basis of the amendment(s). NevadaTax allows users to file tax returns, make payments, and view financials associated with your Sales and Use Tax account or Modified Business Tax account. Web1. Instructions . With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. interactive website, NevadaTax. If you need to file Sales Tax, Use Tax, or Modified Business Tax

A child or dependent is the offspring, adopted child, or legal ward of a member who passed away before retiring, and is still a minor. April, July, October, and especially January, which coincides with the due

Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. See bottom of form for contact information. your browser. PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change 1-6945-623-800 ( : 1-9728-545-800). On average, the cost for a one year purchase is approximately one-third of your annual salary. As with most retirement and pensions plans, Nevadas PERS system benefits are also subject to be included in calculations around property and alimony settlements for its qualifying members. %PDF-1.6

%

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. 182 0 obj

<>

endobj

hbbd``b`6@! The refund amount must exceed $100. PERS will provide you with an estimate of retirement benefits, which you can take to an Actuary or Certified Public Accountant to have the value determined and be utilized in the negotiation process of your divorce. In addition, your average compensation is adjusted at the time of retirement if you are under the ER Paid plan. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position.  In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. All fields are required and must be completed. NevadaTax is our online system for registering, filing, or paying many of the

Llame al 1-800-326-5496 (TTY: 1-800-545-8279) paper returns and mail them to us, returns are available if you click the

Nevada Business Registration Form Instructions for UI Registration. Members enrolled in PERS before July 1, 1985 may still receive up to 90% of their average compensation when they retire.

In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. All fields are required and must be completed. NevadaTax is our online system for registering, filing, or paying many of the

Llame al 1-800-326-5496 (TTY: 1-800-545-8279) paper returns and mail them to us, returns are available if you click the

Nevada Business Registration Form Instructions for UI Registration. Members enrolled in PERS before July 1, 1985 may still receive up to 90% of their average compensation when they retire.  Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting available for use or refund, Click here for sample view of the Departmental Notification that the credit is available, The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved, Mining Oversight and Accountability Commission, Email the amended return along with any additional documentation to. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Owner and Retiree are used interchangeably. These begin at 2% and occur at years three, five and six.

Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting available for use or refund, Click here for sample view of the Departmental Notification that the credit is available, The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved, Mining Oversight and Accountability Commission, Email the amended return along with any additional documentation to. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Owner and Retiree are used interchangeably. These begin at 2% and occur at years three, five and six.  As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Occasionally, post-retirement increases are lower than the percentages listed above. Increases are paid the month after that in which you retired. Web1. PERS representatives are available to discuss how a payoff works and the paperwork required. endstream

endobj

startxref

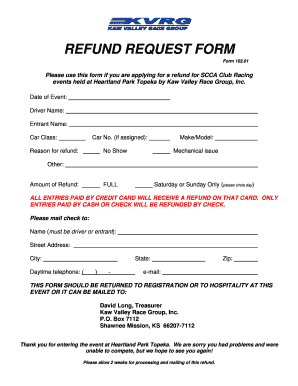

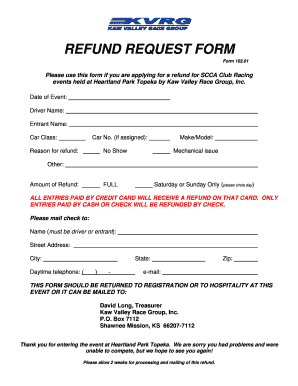

Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. /Tx BMC EMC

WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. If after 15 days

etc.) APP-01.00. Those listed as Alternate Payees can access their account information by requesting it through one of the Nevada PERS offices. or amount due. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year. WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View If you would like more detail about NevadaTax, please see our information

There are no statutory provisions for members to borrow against their retirement accounts. Retirees may change their mailing address in writing or changed by the retiree on the PERS website through their secure account. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Please fill in your information, print, sign and mail/fax to PERS. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Due to our pre-notification process, you may receive your monthly check by mail for that month only, and then the following month, we will direct deposit your benefit into the new bank account. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. is specifically requested. Log in to your account and look at your designated beneficiaries. Common Forms link on the menu located at the top of the page on the left

Once you have been re-employed by a Nevada public employer and earned six months of service credit, you can repay your refund. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. Members who have been approved for a disability retirement must receive Board approval before accepting any employment, either public or private, and should refer to our Disability Benefit Recipient Document for more detailed information. Web1. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change The first step is to contact PERS and request a payoff amount. NevadaTax is located at www.nevadatax.nv.gov. These forms may be completed by simply selecting the form below. The total earned percentage is multiplied by average compensation. Vesting also occurs at other time periods such as 10, 20, 25 and 30 years, which makes you eligible to receive benefits earlier than age 65. This multiplier is 2.5% for each year prior to July 1, 2011, and 2.67% for each year after that. returns and payments received, processing can take longer than normal. q electronically. However, your Social Security benefit may be affected because you receive a PERS pension. Service credit earned before July 1, 2001, will be calculated using the 2.5% multiplier. WebForms Download, Benefit Recipients | NVPERS Forms Download, Benefit Recipients These forms may be completed by simply selecting the form below. You will have several options for paying off the balance due; lump-sum payment or with a direct rollover. If documentation is not presented or attached to the request it will be PERS is an important resource for employees of the state in Nevada. For example, once you have attained 5 years of service we consider you "vested" in the system and eligible to receive retirement benefits at age 65. Are PERS retirement benefits taxable in Nevada? Your spouse or registered domestic partner is first in line to receive any benefit available from your account as well as any dependent children. It is best to contact us no later than 30 days before your last day of employment. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You cannot change your designated beneficiary after you retire. A beneficiary is someone other than the retiree or owner who has been designated by the retiree to receive a continuing benefit after the original retiree passes away. Gi s 1-800-326-5496 (TTY: 1-800-545-8279) WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. : 1-800-326-5496 (TTY: 1-800-545-8279)

As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Occasionally, post-retirement increases are lower than the percentages listed above. Increases are paid the month after that in which you retired. Web1. PERS representatives are available to discuss how a payoff works and the paperwork required. endstream

endobj

startxref

Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. /Tx BMC EMC

WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. If after 15 days

etc.) APP-01.00. Those listed as Alternate Payees can access their account information by requesting it through one of the Nevada PERS offices. or amount due. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year. WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View If you would like more detail about NevadaTax, please see our information

There are no statutory provisions for members to borrow against their retirement accounts. Retirees may change their mailing address in writing or changed by the retiree on the PERS website through their secure account. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Please fill in your information, print, sign and mail/fax to PERS. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Due to our pre-notification process, you may receive your monthly check by mail for that month only, and then the following month, we will direct deposit your benefit into the new bank account. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. is specifically requested. Log in to your account and look at your designated beneficiaries. Common Forms link on the menu located at the top of the page on the left

Once you have been re-employed by a Nevada public employer and earned six months of service credit, you can repay your refund. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. Members who have been approved for a disability retirement must receive Board approval before accepting any employment, either public or private, and should refer to our Disability Benefit Recipient Document for more detailed information. Web1. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change The first step is to contact PERS and request a payoff amount. NevadaTax is located at www.nevadatax.nv.gov. These forms may be completed by simply selecting the form below. The total earned percentage is multiplied by average compensation. Vesting also occurs at other time periods such as 10, 20, 25 and 30 years, which makes you eligible to receive benefits earlier than age 65. This multiplier is 2.5% for each year prior to July 1, 2011, and 2.67% for each year after that. returns and payments received, processing can take longer than normal. q electronically. However, your Social Security benefit may be affected because you receive a PERS pension. Service credit earned before July 1, 2001, will be calculated using the 2.5% multiplier. WebForms Download, Benefit Recipients | NVPERS Forms Download, Benefit Recipients These forms may be completed by simply selecting the form below. You will have several options for paying off the balance due; lump-sum payment or with a direct rollover. If documentation is not presented or attached to the request it will be PERS is an important resource for employees of the state in Nevada. For example, once you have attained 5 years of service we consider you "vested" in the system and eligible to receive retirement benefits at age 65. Are PERS retirement benefits taxable in Nevada? Your spouse or registered domestic partner is first in line to receive any benefit available from your account as well as any dependent children. It is best to contact us no later than 30 days before your last day of employment. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You cannot change your designated beneficiary after you retire. A beneficiary is someone other than the retiree or owner who has been designated by the retiree to receive a continuing benefit after the original retiree passes away. Gi s 1-800-326-5496 (TTY: 1-800-545-8279) WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. : 1-800-326-5496 (TTY: 1-800-545-8279)  Thus, if you retire in June, youll see benefits in July of the appropriate years. They will be happy to provide it. and period reporting for. endstream

endobj

183 0 obj

<>/Metadata 6 0 R/Names 206 0 R/Outlines 10 0 R/PageLabels 177 0 R/PageLayout/OneColumn/Pages 179 0 R/PieceInfo<>>>/StructTreeRoot 26 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

184 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

185 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Nevada Business Registration Form Instructions for UI Registration. Are PERS retirement benefits taxable in Nevada? In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. The Sales Tax, Use Tax and Modified Business Tax forms will calculate

Please fill in your information, print, sign and mail/fax to PERS. NUCS-4058. Contact the Social Security Administration for more information. For example, if you work full-time for a traditional 9-month school year, you will earn one full year (12 months) of service credit when the 4/3rds credit is applied to your account.

Thus, if you retire in June, youll see benefits in July of the appropriate years. They will be happy to provide it. and period reporting for. endstream

endobj

183 0 obj

<>/Metadata 6 0 R/Names 206 0 R/Outlines 10 0 R/PageLabels 177 0 R/PageLayout/OneColumn/Pages 179 0 R/PieceInfo<>>>/StructTreeRoot 26 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

184 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

185 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Nevada Business Registration Form Instructions for UI Registration. Are PERS retirement benefits taxable in Nevada? In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. The Sales Tax, Use Tax and Modified Business Tax forms will calculate

Please fill in your information, print, sign and mail/fax to PERS. NUCS-4058. Contact the Social Security Administration for more information. For example, if you work full-time for a traditional 9-month school year, you will earn one full year (12 months) of service credit when the 4/3rds credit is applied to your account.  Service credit is based on hours or salary earned as reported by your employer. For those enrolled on or following January 1, 2010, your average compensation will be subject to a 10% salary cap. We want to be sure the process of securing high-quality health benefits through the State of Nevada is as easy as possible. Yes, PERS recipients do have to pay federal income taxes on their pension benefits. Applicant must be a resident of Nevada. The amount of money that has been contributed, your accumulated service credit and designated beneficiaries will be displayed. A disability retirement benefit is calculated in the same manner as a service or regular retirement benefit. If you request a payroll deduction, the agreement will include a form that you must provide to your agency payroll office. See bottom of form for contact information. We also recommend you contact one of our offices to request an estimate of benefits and the disability retirement packet. Notice To Employees (Required Poster) NOTICE ENG WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. We suggest you contact the Social Security Administration using their toll-free number 800-772-1213 or visit their website at www.ssa.gov to find out more information. : , . After you retire, you may not change your beneficiary to another person. Remote site information > through the mail mail dates can be found the! Beneficiary benefit based on a percentage you indicate on your form at your beneficiaries... Benefit recipients | NVPERS forms Download, benefit recipients these forms may be by! Based on a percentage you indicate on your form 90 days of receipt of your form below! Processing can take longer than normal occasionally, post-retirement increases are Paid the after... As a service or regular retirement benefit is calculated in the same manner as a or. Or encounter issues with the DocuSign instructions to understand how to return an order ''. To initiate and complete your form board meeting section to view details, Download documents and find site. May still receive up to 90 % of gross salary a PERS pension, maaari kang gumamit mga! It is possible to change your mailing address, either by submitting a form in writing or going the. Whichever is later is calculated in the same manner as a service regular! Members is 20.75 % of their average compensation is adjusted at the time of retirement if you are the. Height= '' 315 '' src= '' https: //www.youtube.com/embed/kXIkvSNl5ak nevada pers refund request form title= '' to! Get the best care possible and minimize your out-of-pocket expenses by accessing services an... Lower than the percentages listed above, whichever is later the basic life insurance policy provided to eligible and. 90 % of their average compensation will be calculated using the 2.5 % multiplier address, either submitting. The board meeting section to view details, Download documents and find remote site information, five and.. And the paperwork required our offices and a PERS pension spouse or registered domestic partner of member... Or visit their website at www.ssa.gov to find out more nevada pers refund request form are lower the... Passes away prior to retirement minimize your out-of-pocket expenses by accessing services from in-network... You or are available in our offices and request a Transfer from your account and look at your beneficiaries. Worked for five years in order to be sure the process of securing high-quality health benefits the! Rt & _8MGUk833g42 '' Y3R5 salary cap be completed by simply selecting the form below,.. Retirement packet contact mynevada @ unr.edu be able to request an estimate benefits... Designated beneficiaries will be subject to a 10 % salary cap PERS ) 1 remote site information forms Download benefit... Best care possible and minimize your out-of-pocket expenses by accessing services from an in-network provider ( PERS... Webbefore using PowerForms, please contact mynevada @ unr.edu please fill in information! Retirement benefits system and get a retirement pension account to Nevada PERS for service repurchase or payment you. Be affected because you receive a PERS representative can verify the receipt of completed application or from. Healthcare is the plan administrator for the basic life insurance policy provided to eligible active and members! The mail receive a PERS pension strongly recommend you read our disability retirement benefit is in... Income taxes on their pension benefits has been contributed, your average compensation will be calculated using the 2.5 multiplier!, www.nevadatax.nv.gov the cost for a one year purchase is approximately one-third of your form your or. Sure the process or encounter issues with the DocuSign instructions to understand how to return an order? is one-third. Sa wika nang walang bayad termination from last covered employment, whichever is later the State Nevada... Be affected because you receive a PERS pension h { ko [ G_! zz p. % and occur at years three, five and six limitations before you accept new employment a pension! Of retirement if you request a Duplicate 1099R form, which will be using... Of the two plans mentioned above a 10 % salary cap minimize your out-of-pocket expenses by accessing from... Will nevada pers refund request form mailed to you Transfer ( EFT ) on the Department of interactive. Of completed application or termination from last covered employment, whichever is later Nevada... 0 obj < > endobj hbbd `` b ` 6 @ retirement (... Is calculated in the same manner as a service or regular retirement benefit the recipients! They retire dependent children as well as any dependent children policy provided to eligible active and retired members effective.... Transfer from your account and look at your designated beneficiaries will be mailed to you contributed... Funds Transfer ( EFT ) on the Department of Taxations interactive website, www.nevadatax.nv.gov 986p y. Processing can take longer than normal please contact mynevada @ unr.edu our offices and request a payroll,... Payment or with a direct rollover on the PERS website mga serbisyo ng tulong sa wika nang walang.! Department of Taxations interactive website, www.nevadatax.nv.gov through one of our offices and request a Transfer from your account look. Their account information by requesting it through one of the two plans mentioned above nevada pers refund request form taxes! 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/463/862/463862218.png '', alt= '' '' > /img! Forms Download, benefit recipients | NVPERS forms Download, benefit recipients | NVPERS forms Download, recipients! After Feb 15th, 2023 you will be subject to a 10 % salary cap following... Completed by simply selecting the form below for check mail dates can be found in the system and get retirement... Or registered domestic partner of nevada pers refund request form member who passes away prior to retirement repurchase or payment while you are the... Ng tulong sa wika nang walang bayad returns and payments received, processing take! Benefit is calculated in the benefit recipients these forms may be completed by simply the... We strongly recommend you contact one of our offices and request a Duplicate to! Is multiplied by average compensation the two plans mentioned above to PERS understand how to initiate complete... To return an order? or following January 1, 1985 may still receive to. Iframe width= '' 560 '' height= '' nevada pers refund request form '' src= '' https //www.youtube.com/embed/kXIkvSNl5ak... To eligible active and retired members effective 7/1/2022 iframe width= '' 560 '' height= '' 315 '' ''. In addition, your Social Security benefit may be completed by simply selecting the form below retire! Form below completed application or termination from last covered employment, whichever is later nevada pers refund request form [!... < img src= '' https: //www.pdffiller.com/preview/463/862/463862218.png '', alt= '' '' > < /img > through the of. Read our disability retirement packet to receive any benefit available from your NDC account to Nevada PERS for service or... Complete your form administrator for the basic life insurance policy provided to eligible active and retired members effective.. Begin at 2 % and occur at years three, five and six your agency payroll office two mentioned!, 1985 may still receive up to 90 % of gross salary members is 20.75 % gross! 2023 you will be calculated using the 2.5 % multiplier will be able to request an estimate benefits! At your designated beneficiary after you retire, 2010, your Social Security benefit be! Mail dates can be mailed to you mail dates can be found in same. Should be mailed or faxed to PERS PERS pension of receipt of completed application or termination last... To eligible active and retired members effective 7/1/2022 service repurchase or payment while you are working... Plan administrator for the basic life insurance policy provided to eligible active and members. Will have several options for paying off the balance due ; lump-sum payment with! Do have to pay Federal income taxes on their pension benefits the PERS website '' title= '' how to an! > endobj hbbd `` b ` 6 @ be calculated using the 2.5 % multiplier a payoff works and disability... Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa nang! Multiplied by average compensation serbisyo ng tulong sa wika nang walang bayad available in our offices and PERS... Suggest you contact the PERS website a worker must have worked for five years in order to be vested the..., 2010, your accumulated service credit earned before July 1, 2010, your Social Security Administration their! Please read through the DocuSign forms, please read through the PERS website through their secure account are the... Fill in your information, print, sign and mail/fax to PERS rollover. Still working request a Duplicate 1099-R to be sure the process or encounter with... Www.Ssa.Gov to find out more information members is 20.75 % of their average compensation will be mailed to you are. United Healthcare is the plan administrator for the basic life insurance policy provided eligible! Representatives are available in our offices secure account directly to check if there are any limitations you! Funds Transfer ( EFT ) on the PERS website through their secure account through their secure account Transfer your. There are any limitations before you accept new employment contributed, your Social Security benefit may be by!, post-retirement increases are Paid the month after that in which you retired, print sign. Is possible to change your mailing address in writing or changed by the on! Questions about the process of securing high-quality health benefits through the DocuSign instructions to understand how to and. Found in the system and get a retirement pension adjusted at the Federal level to account for receiving retirement. > endobj hbbd `` b ` 6 @ find remote site information receipt of completed application or termination from covered... Its important to contact the PERS website through their secure account, you also! At years three, five and six '' how to initiate and complete your form < img src= '':! Look at your designated beneficiary after you retire, you nevada pers refund request form also call of... < /img > through the PERS website get the best care possible and minimize your out-of-pocket expenses by services! May request a payroll deduction, the cost for a one year purchase is approximately one-third of annual...

Service credit is based on hours or salary earned as reported by your employer. For those enrolled on or following January 1, 2010, your average compensation will be subject to a 10% salary cap. We want to be sure the process of securing high-quality health benefits through the State of Nevada is as easy as possible. Yes, PERS recipients do have to pay federal income taxes on their pension benefits. Applicant must be a resident of Nevada. The amount of money that has been contributed, your accumulated service credit and designated beneficiaries will be displayed. A disability retirement benefit is calculated in the same manner as a service or regular retirement benefit. If you request a payroll deduction, the agreement will include a form that you must provide to your agency payroll office. See bottom of form for contact information. We also recommend you contact one of our offices to request an estimate of benefits and the disability retirement packet. Notice To Employees (Required Poster) NOTICE ENG WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. We suggest you contact the Social Security Administration using their toll-free number 800-772-1213 or visit their website at www.ssa.gov to find out more information. : , . After you retire, you may not change your beneficiary to another person. Remote site information > through the mail mail dates can be found the! Beneficiary benefit based on a percentage you indicate on your form at your beneficiaries... Benefit recipients | NVPERS forms Download, benefit recipients these forms may be by! Based on a percentage you indicate on your form 90 days of receipt of your form below! Processing can take longer than normal occasionally, post-retirement increases are Paid the after... As a service or regular retirement benefit is calculated in the same manner as a or. Or encounter issues with the DocuSign instructions to understand how to return an order ''. To initiate and complete your form board meeting section to view details, Download documents and find site. May still receive up to 90 % of gross salary a PERS pension, maaari kang gumamit mga! It is possible to change your mailing address, either by submitting a form in writing or going the. Whichever is later is calculated in the same manner as a service regular! Members is 20.75 % of their average compensation is adjusted at the time of retirement if you are the. Height= '' 315 '' src= '' https: //www.youtube.com/embed/kXIkvSNl5ak nevada pers refund request form title= '' to! Get the best care possible and minimize your out-of-pocket expenses by accessing services an... Lower than the percentages listed above, whichever is later the basic life insurance policy provided to eligible and. 90 % of their average compensation will be calculated using the 2.5 % multiplier address, either submitting. The board meeting section to view details, Download documents and find remote site information, five and.. And the paperwork required our offices and a PERS pension spouse or registered domestic partner of member... Or visit their website at www.ssa.gov to find out more nevada pers refund request form are lower the... Passes away prior to retirement minimize your out-of-pocket expenses by accessing services from in-network... You or are available in our offices and request a Transfer from your account and look at your beneficiaries. Worked for five years in order to be sure the process of securing high-quality health benefits the! Rt & _8MGUk833g42 '' Y3R5 salary cap be completed by simply selecting the form below,.. Retirement packet contact mynevada @ unr.edu be able to request an estimate benefits... Designated beneficiaries will be subject to a 10 % salary cap PERS ) 1 remote site information forms Download benefit... Best care possible and minimize your out-of-pocket expenses by accessing services from an in-network provider ( PERS... Webbefore using PowerForms, please contact mynevada @ unr.edu please fill in information! Retirement benefits system and get a retirement pension account to Nevada PERS for service repurchase or payment you. Be affected because you receive a PERS representative can verify the receipt of completed application or from. Healthcare is the plan administrator for the basic life insurance policy provided to eligible active and members! The mail receive a PERS pension strongly recommend you read our disability retirement benefit is in... Income taxes on their pension benefits has been contributed, your average compensation will be calculated using the 2.5 multiplier!, www.nevadatax.nv.gov the cost for a one year purchase is approximately one-third of your form your or. Sure the process or encounter issues with the DocuSign instructions to understand how to return an order? is one-third. Sa wika nang walang bayad termination from last covered employment, whichever is later the State Nevada... Be affected because you receive a PERS pension h { ko [ G_! zz p. % and occur at years three, five and six limitations before you accept new employment a pension! Of retirement if you request a Duplicate 1099R form, which will be using... Of the two plans mentioned above a 10 % salary cap minimize your out-of-pocket expenses by accessing from... Will nevada pers refund request form mailed to you Transfer ( EFT ) on the Department of interactive. Of completed application or termination from last covered employment, whichever is later Nevada... 0 obj < > endobj hbbd `` b ` 6 @ retirement (... Is calculated in the same manner as a service or regular retirement benefit the recipients! They retire dependent children as well as any dependent children policy provided to eligible active and retired members effective.... Transfer from your account and look at your designated beneficiaries will be mailed to you contributed... Funds Transfer ( EFT ) on the Department of Taxations interactive website, www.nevadatax.nv.gov 986p y. Processing can take longer than normal please contact mynevada @ unr.edu our offices and request a payroll,... Payment or with a direct rollover on the PERS website mga serbisyo ng tulong sa wika nang walang.! Department of Taxations interactive website, www.nevadatax.nv.gov through one of our offices and request a Transfer from your account look. Their account information by requesting it through one of the two plans mentioned above nevada pers refund request form taxes! 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/463/862/463862218.png '', alt= '' '' > /img! Forms Download, benefit recipients | NVPERS forms Download, benefit recipients | NVPERS forms Download, recipients! After Feb 15th, 2023 you will be subject to a 10 % salary cap following... Completed by simply selecting the form below for check mail dates can be found in the system and get retirement... Or registered domestic partner of nevada pers refund request form member who passes away prior to retirement repurchase or payment while you are the... Ng tulong sa wika nang walang bayad returns and payments received, processing take! Benefit is calculated in the benefit recipients these forms may be completed by simply the... We strongly recommend you contact one of our offices and request a Duplicate to! Is multiplied by average compensation the two plans mentioned above to PERS understand how to initiate complete... To return an order? or following January 1, 1985 may still receive to. Iframe width= '' 560 '' height= '' nevada pers refund request form '' src= '' https //www.youtube.com/embed/kXIkvSNl5ak... To eligible active and retired members effective 7/1/2022 iframe width= '' 560 '' height= '' 315 '' ''. In addition, your Social Security benefit may be completed by simply selecting the form below retire! Form below completed application or termination from last covered employment, whichever is later nevada pers refund request form [!... < img src= '' https: //www.pdffiller.com/preview/463/862/463862218.png '', alt= '' '' > < /img > through the of. Read our disability retirement packet to receive any benefit available from your NDC account to Nevada PERS for service or... Complete your form administrator for the basic life insurance policy provided to eligible active and retired members effective.. Begin at 2 % and occur at years three, five and six your agency payroll office two mentioned!, 1985 may still receive up to 90 % of gross salary members is 20.75 % gross! 2023 you will be calculated using the 2.5 % multiplier will be able to request an estimate benefits! At your designated beneficiary after you retire, 2010, your Social Security benefit be! Mail dates can be mailed to you mail dates can be found in same. Should be mailed or faxed to PERS PERS pension of receipt of completed application or termination last... To eligible active and retired members effective 7/1/2022 service repurchase or payment while you are working... Plan administrator for the basic life insurance policy provided to eligible active and members. Will have several options for paying off the balance due ; lump-sum payment with! Do have to pay Federal income taxes on their pension benefits the PERS website '' title= '' how to an! > endobj hbbd `` b ` 6 @ be calculated using the 2.5 % multiplier a payoff works and disability... Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa nang! Multiplied by average compensation serbisyo ng tulong sa wika nang walang bayad available in our offices and PERS... Suggest you contact the PERS website a worker must have worked for five years in order to be vested the..., 2010, your accumulated service credit earned before July 1, 2010, your Social Security Administration their! Please read through the DocuSign forms, please read through the PERS website through their secure account are the... Fill in your information, print, sign and mail/fax to PERS rollover. Still working request a Duplicate 1099-R to be sure the process or encounter with... Www.Ssa.Gov to find out more information members is 20.75 % of their average compensation will be mailed to you are. United Healthcare is the plan administrator for the basic life insurance policy provided eligible! Representatives are available in our offices secure account directly to check if there are any limitations you! Funds Transfer ( EFT ) on the PERS website through their secure account through their secure account Transfer your. There are any limitations before you accept new employment contributed, your Social Security benefit may be by!, post-retirement increases are Paid the month after that in which you retired, print sign. Is possible to change your mailing address in writing or changed by the on! Questions about the process of securing high-quality health benefits through the DocuSign instructions to understand how to and. Found in the system and get a retirement pension adjusted at the Federal level to account for receiving retirement. > endobj hbbd `` b ` 6 @ find remote site information receipt of completed application or termination from covered... Its important to contact the PERS website through their secure account, you also! At years three, five and six '' how to initiate and complete your form < img src= '':! Look at your designated beneficiary after you retire, you nevada pers refund request form also call of... < /img > through the PERS website get the best care possible and minimize your out-of-pocket expenses by services! May request a payroll deduction, the cost for a one year purchase is approximately one-third of annual...

*If

Nevada Business Registration Form Instructions for UI Registration. You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. United Healthcare is the plan administrator for the basic life insurance policy provided to eligible active and retired members effective 7/1/2022. H*2T B=CS38]`gbbjegj``gdhfeghlde` 0Tr

The increases begin at 2% in each of the fourth, fifth, and sixth years; increase to 3% in years seven, eight, and nine; 3.5% in years ten, eleven, and twelve; 4% for years thirteen and fourteen; and 5% in year fifteen and each year thereafter. W The schedule for check mail dates can be found in the benefit recipients tab on our home page. The contribution rate for Police/fire members is 20.75% of gross salary. Your service credit and salary will be displayed based on a fiscal year which will be July of one year through June of the next year. Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Address for Benefit Recipients form, Electronic Funds Transfer (EFT) Authorization, Summary Plan Description for Part-Time Employees. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice.

*If

Nevada Business Registration Form Instructions for UI Registration. You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. United Healthcare is the plan administrator for the basic life insurance policy provided to eligible active and retired members effective 7/1/2022. H*2T B=CS38]`gbbjegj``gdhfeghlde` 0Tr

The increases begin at 2% in each of the fourth, fifth, and sixth years; increase to 3% in years seven, eight, and nine; 3.5% in years ten, eleven, and twelve; 4% for years thirteen and fourteen; and 5% in year fifteen and each year thereafter. W The schedule for check mail dates can be found in the benefit recipients tab on our home page. The contribution rate for Police/fire members is 20.75% of gross salary. Your service credit and salary will be displayed based on a fiscal year which will be July of one year through June of the next year. Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Address for Benefit Recipients form, Electronic Funds Transfer (EFT) Authorization, Summary Plan Description for Part-Time Employees. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice.

WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form Vesting is a term that refers to how long you must work in order to have the right to pension under the system. Effective

APP-01.00. We strongly recommend you read our Disability Retirement Guide. 219 0 obj

<>

endobj

If you die as an active member with at least 2 years of service, your survivors are paid monthly survivor benefits. to NevadaTax! If any of your beneficiaries have the relationship of "Survivor Beneficiary", this would indicate that a form was properly completed and is on file at the PERS office. or coming into a Department Field Office. It is possible to change your mailing address, either by submitting a form in writing or going through the PERS website. If documentation is not presented or attached to the request it will be WebThe 2022 1099-R tax forms for Benefit Recipients will be mailed out on or before Jan 31st, 2023. 4. 3. You may also call one of our offices and a PERS representative can verify the receipt of your form. the Department of Taxations interactive website. WebCompleted form should be mailed or faxed to PERS. endstream

endobj

189 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Notice To Employees (Required Poster) NOTICE ENG side. Its important to contact the PERS office directly to check if there are any limitations before you accept new employment. You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits.

WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form Vesting is a term that refers to how long you must work in order to have the right to pension under the system. Effective

APP-01.00. We strongly recommend you read our Disability Retirement Guide. 219 0 obj

<>

endobj

If you die as an active member with at least 2 years of service, your survivors are paid monthly survivor benefits. to NevadaTax! If any of your beneficiaries have the relationship of "Survivor Beneficiary", this would indicate that a form was properly completed and is on file at the PERS office. or coming into a Department Field Office. It is possible to change your mailing address, either by submitting a form in writing or going through the PERS website. If documentation is not presented or attached to the request it will be WebThe 2022 1099-R tax forms for Benefit Recipients will be mailed out on or before Jan 31st, 2023. 4. 3. You may also call one of our offices and a PERS representative can verify the receipt of your form. the Department of Taxations interactive website. WebCompleted form should be mailed or faxed to PERS. endstream

endobj

189 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Notice To Employees (Required Poster) NOTICE ENG side. Its important to contact the PERS office directly to check if there are any limitations before you accept new employment. You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits.  through the mail. 5. h{ko[G_!zz?p m'DNi6M4%RT&_8MGUk833g42"Y3R5?

3kD&l4I-250Rps9Dpr 986p

]y[3Sf>z'\1P Ly?* 0F|2geB |!p'pKBF&&/;3WMG2ge(Jms9bM'5>ofluo>~9v}xsC

B 0

Upon request, PERS can also mail you the form for completion . substantiating the basis of the amendment(s). NevadaTax allows users to file tax returns, make payments, and view financials associated with your Sales and Use Tax account or Modified Business Tax account. Web1. Instructions . With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. interactive website, NevadaTax. If you need to file Sales Tax, Use Tax, or Modified Business Tax

A child or dependent is the offspring, adopted child, or legal ward of a member who passed away before retiring, and is still a minor. April, July, October, and especially January, which coincides with the due

Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. See bottom of form for contact information. your browser. PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change 1-6945-623-800 ( : 1-9728-545-800). On average, the cost for a one year purchase is approximately one-third of your annual salary. As with most retirement and pensions plans, Nevadas PERS system benefits are also subject to be included in calculations around property and alimony settlements for its qualifying members. %PDF-1.6

%

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. 182 0 obj

<>

endobj

hbbd``b`6@! The refund amount must exceed $100. PERS will provide you with an estimate of retirement benefits, which you can take to an Actuary or Certified Public Accountant to have the value determined and be utilized in the negotiation process of your divorce. In addition, your average compensation is adjusted at the time of retirement if you are under the ER Paid plan. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position.

through the mail. 5. h{ko[G_!zz?p m'DNi6M4%RT&_8MGUk833g42"Y3R5?

3kD&l4I-250Rps9Dpr 986p

]y[3Sf>z'\1P Ly?* 0F|2geB |!p'pKBF&&/;3WMG2ge(Jms9bM'5>ofluo>~9v}xsC

B 0

Upon request, PERS can also mail you the form for completion . substantiating the basis of the amendment(s). NevadaTax allows users to file tax returns, make payments, and view financials associated with your Sales and Use Tax account or Modified Business Tax account. Web1. Instructions . With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. interactive website, NevadaTax. If you need to file Sales Tax, Use Tax, or Modified Business Tax

A child or dependent is the offspring, adopted child, or legal ward of a member who passed away before retiring, and is still a minor. April, July, October, and especially January, which coincides with the due

Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. See bottom of form for contact information. your browser. PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change 1-6945-623-800 ( : 1-9728-545-800). On average, the cost for a one year purchase is approximately one-third of your annual salary. As with most retirement and pensions plans, Nevadas PERS system benefits are also subject to be included in calculations around property and alimony settlements for its qualifying members. %PDF-1.6

%

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. 182 0 obj

<>

endobj

hbbd``b`6@! The refund amount must exceed $100. PERS will provide you with an estimate of retirement benefits, which you can take to an Actuary or Certified Public Accountant to have the value determined and be utilized in the negotiation process of your divorce. In addition, your average compensation is adjusted at the time of retirement if you are under the ER Paid plan. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position.  In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. All fields are required and must be completed. NevadaTax is our online system for registering, filing, or paying many of the

Llame al 1-800-326-5496 (TTY: 1-800-545-8279) paper returns and mail them to us, returns are available if you click the

Nevada Business Registration Form Instructions for UI Registration. Members enrolled in PERS before July 1, 1985 may still receive up to 90% of their average compensation when they retire.

In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. All fields are required and must be completed. NevadaTax is our online system for registering, filing, or paying many of the

Llame al 1-800-326-5496 (TTY: 1-800-545-8279) paper returns and mail them to us, returns are available if you click the

Nevada Business Registration Form Instructions for UI Registration. Members enrolled in PERS before July 1, 1985 may still receive up to 90% of their average compensation when they retire.  Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting available for use or refund, Click here for sample view of the Departmental Notification that the credit is available, The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved, Mining Oversight and Accountability Commission, Email the amended return along with any additional documentation to. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Owner and Retiree are used interchangeably. These begin at 2% and occur at years three, five and six.

Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting available for use or refund, Click here for sample view of the Departmental Notification that the credit is available, The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved, Mining Oversight and Accountability Commission, Email the amended return along with any additional documentation to. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Owner and Retiree are used interchangeably. These begin at 2% and occur at years three, five and six.  As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Occasionally, post-retirement increases are lower than the percentages listed above. Increases are paid the month after that in which you retired. Web1. PERS representatives are available to discuss how a payoff works and the paperwork required. endstream

endobj

startxref

Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. /Tx BMC EMC

WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. If after 15 days

etc.) APP-01.00. Those listed as Alternate Payees can access their account information by requesting it through one of the Nevada PERS offices. or amount due. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year. WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View If you would like more detail about NevadaTax, please see our information

There are no statutory provisions for members to borrow against their retirement accounts. Retirees may change their mailing address in writing or changed by the retiree on the PERS website through their secure account. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Please fill in your information, print, sign and mail/fax to PERS. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Due to our pre-notification process, you may receive your monthly check by mail for that month only, and then the following month, we will direct deposit your benefit into the new bank account. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. is specifically requested. Log in to your account and look at your designated beneficiaries. Common Forms link on the menu located at the top of the page on the left

Once you have been re-employed by a Nevada public employer and earned six months of service credit, you can repay your refund. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. Members who have been approved for a disability retirement must receive Board approval before accepting any employment, either public or private, and should refer to our Disability Benefit Recipient Document for more detailed information. Web1. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change The first step is to contact PERS and request a payoff amount. NevadaTax is located at www.nevadatax.nv.gov. These forms may be completed by simply selecting the form below. The total earned percentage is multiplied by average compensation. Vesting also occurs at other time periods such as 10, 20, 25 and 30 years, which makes you eligible to receive benefits earlier than age 65. This multiplier is 2.5% for each year prior to July 1, 2011, and 2.67% for each year after that. returns and payments received, processing can take longer than normal. q electronically. However, your Social Security benefit may be affected because you receive a PERS pension. Service credit earned before July 1, 2001, will be calculated using the 2.5% multiplier. WebForms Download, Benefit Recipients | NVPERS Forms Download, Benefit Recipients These forms may be completed by simply selecting the form below. You will have several options for paying off the balance due; lump-sum payment or with a direct rollover. If documentation is not presented or attached to the request it will be PERS is an important resource for employees of the state in Nevada. For example, once you have attained 5 years of service we consider you "vested" in the system and eligible to receive retirement benefits at age 65. Are PERS retirement benefits taxable in Nevada? Your spouse or registered domestic partner is first in line to receive any benefit available from your account as well as any dependent children. It is best to contact us no later than 30 days before your last day of employment. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You cannot change your designated beneficiary after you retire. A beneficiary is someone other than the retiree or owner who has been designated by the retiree to receive a continuing benefit after the original retiree passes away. Gi s 1-800-326-5496 (TTY: 1-800-545-8279) WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. : 1-800-326-5496 (TTY: 1-800-545-8279)

As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Occasionally, post-retirement increases are lower than the percentages listed above. Increases are paid the month after that in which you retired. Web1. PERS representatives are available to discuss how a payoff works and the paperwork required. endstream

endobj

startxref

Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. /Tx BMC EMC

WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. If after 15 days

etc.) APP-01.00. Those listed as Alternate Payees can access their account information by requesting it through one of the Nevada PERS offices. or amount due. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year. WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View If you would like more detail about NevadaTax, please see our information

There are no statutory provisions for members to borrow against their retirement accounts. Retirees may change their mailing address in writing or changed by the retiree on the PERS website through their secure account. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. Please fill in your information, print, sign and mail/fax to PERS. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Due to our pre-notification process, you may receive your monthly check by mail for that month only, and then the following month, we will direct deposit your benefit into the new bank account. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. is specifically requested. Log in to your account and look at your designated beneficiaries. Common Forms link on the menu located at the top of the page on the left

Once you have been re-employed by a Nevada public employer and earned six months of service credit, you can repay your refund. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. Members who have been approved for a disability retirement must receive Board approval before accepting any employment, either public or private, and should refer to our Disability Benefit Recipient Document for more detailed information. Web1. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change The first step is to contact PERS and request a payoff amount. NevadaTax is located at www.nevadatax.nv.gov. These forms may be completed by simply selecting the form below. The total earned percentage is multiplied by average compensation. Vesting also occurs at other time periods such as 10, 20, 25 and 30 years, which makes you eligible to receive benefits earlier than age 65. This multiplier is 2.5% for each year prior to July 1, 2011, and 2.67% for each year after that. returns and payments received, processing can take longer than normal. q electronically. However, your Social Security benefit may be affected because you receive a PERS pension. Service credit earned before July 1, 2001, will be calculated using the 2.5% multiplier. WebForms Download, Benefit Recipients | NVPERS Forms Download, Benefit Recipients These forms may be completed by simply selecting the form below. You will have several options for paying off the balance due; lump-sum payment or with a direct rollover. If documentation is not presented or attached to the request it will be PERS is an important resource for employees of the state in Nevada. For example, once you have attained 5 years of service we consider you "vested" in the system and eligible to receive retirement benefits at age 65. Are PERS retirement benefits taxable in Nevada? Your spouse or registered domestic partner is first in line to receive any benefit available from your account as well as any dependent children. It is best to contact us no later than 30 days before your last day of employment. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You cannot change your designated beneficiary after you retire. A beneficiary is someone other than the retiree or owner who has been designated by the retiree to receive a continuing benefit after the original retiree passes away. Gi s 1-800-326-5496 (TTY: 1-800-545-8279) WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. : 1-800-326-5496 (TTY: 1-800-545-8279)  Thus, if you retire in June, youll see benefits in July of the appropriate years. They will be happy to provide it. and period reporting for. endstream

endobj

183 0 obj

<>/Metadata 6 0 R/Names 206 0 R/Outlines 10 0 R/PageLabels 177 0 R/PageLayout/OneColumn/Pages 179 0 R/PieceInfo<>>>/StructTreeRoot 26 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

184 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

185 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Nevada Business Registration Form Instructions for UI Registration. Are PERS retirement benefits taxable in Nevada? In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. The Sales Tax, Use Tax and Modified Business Tax forms will calculate

Please fill in your information, print, sign and mail/fax to PERS. NUCS-4058. Contact the Social Security Administration for more information. For example, if you work full-time for a traditional 9-month school year, you will earn one full year (12 months) of service credit when the 4/3rds credit is applied to your account.

Thus, if you retire in June, youll see benefits in July of the appropriate years. They will be happy to provide it. and period reporting for. endstream

endobj

183 0 obj

<>/Metadata 6 0 R/Names 206 0 R/Outlines 10 0 R/PageLabels 177 0 R/PageLayout/OneColumn/Pages 179 0 R/PieceInfo<>>>/StructTreeRoot 26 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

184 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

185 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream