Behind the Fortunly name stands a group of enthusiasts - Next, provide the check to that person so they can deposit or cash the check. Some banks, such as US Bank, PNC Bank, and TD Bank, offer same-day service, with a portion of the check available to withdraw on the same business day. Make a plan before signing a check with another person. How Long Does It Take To Deposit a Check at an ATM? PNC also accepts third-party check deposits from account holders as long as the check features the signature of both the account holder and the person to whom the check was originally addressed. Fortunly.coms in-house writing team writes all the sites content  Can You Sign a Check Over to Somebody Else? If a check is returned due to insufficient funds, PNC will not debit your account. Banks might not be willing to accept checks that have been signed over to a third party (that is, somebody besides the check writer and the original payee). reviews has been solely collected by Fortunly.com and has not been reviewed or provided by the (Bring ID, of course.). review, but they dont affect the reviews content in any way. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts And always check with the recipient to make sure their bank accepts third-party checks. ", Consumer Financial Protection Bureau. Yes | No Comment Reply Report Anonymous 0 0 Also, they may think that a third-party check is a red flag, so they might refuse to deposit or cash these checks. No matter the financial institution you use -- whether a traditional bank or credit union -- when you write a paper check, it Do you know how much you are paying in banking fees? WebFor any check amount from $25 to $100, a $2 fee will apply to each check. Complaints of check fraud including cashiers check fraud have been increasing. Its much safer to deposit checks than to carry large amounts of cash around with you. Go to PNC Bank Website. PNCs cashiers check fee is $10 per check, but theres more to know about cashiers checks than just the fee. If you go to an ATM, the whole process weve described above will take just a couple of minutes. WebPnc third party check deposit rhondam469 Level 1 (Contributor) 1 Answer 1 0 Most banks will tell u it may take 5-7 days.whenits only 2-3 days,every thing is checked by wire. To sign a check over to another person or to a business ("third-party check"), verify that a bank will accept the check. Webull vs. Robinhood: Which Online Broker Is Better for Your Needs? When you insert a check, the machine will use software known as optical character recognition software to capture the information on the check.

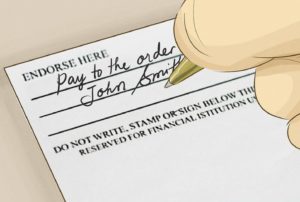

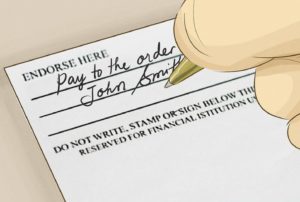

Can You Sign a Check Over to Somebody Else? If a check is returned due to insufficient funds, PNC will not debit your account. Banks might not be willing to accept checks that have been signed over to a third party (that is, somebody besides the check writer and the original payee). reviews has been solely collected by Fortunly.com and has not been reviewed or provided by the (Bring ID, of course.). review, but they dont affect the reviews content in any way. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts And always check with the recipient to make sure their bank accepts third-party checks. ", Consumer Financial Protection Bureau. Yes | No Comment Reply Report Anonymous 0 0 Also, they may think that a third-party check is a red flag, so they might refuse to deposit or cash these checks. No matter the financial institution you use -- whether a traditional bank or credit union -- when you write a paper check, it Do you know how much you are paying in banking fees? WebFor any check amount from $25 to $100, a $2 fee will apply to each check. Complaints of check fraud including cashiers check fraud have been increasing. Its much safer to deposit checks than to carry large amounts of cash around with you. Go to PNC Bank Website. PNCs cashiers check fee is $10 per check, but theres more to know about cashiers checks than just the fee. If you go to an ATM, the whole process weve described above will take just a couple of minutes. WebPnc third party check deposit rhondam469 Level 1 (Contributor) 1 Answer 1 0 Most banks will tell u it may take 5-7 days.whenits only 2-3 days,every thing is checked by wire. To sign a check over to another person or to a business ("third-party check"), verify that a bank will accept the check. Webull vs. Robinhood: Which Online Broker Is Better for Your Needs? When you insert a check, the machine will use software known as optical character recognition software to capture the information on the check.  How To Endorse & Deposit Someone Else's Check, How to Spot, Report and Avoid Fake Check Scams, Some banks will allow you to sign a check over to someone else, also known as a "third-party check.". "How Quickly Can I Get My Money After I Deposit a Check Into My Checking Account? If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Banks usually provide this service through a network of local ATMs and branch offices. Banks are hesitant to cash third-party checks and often will accept them for deposit only. Find out if its allowed first, and learn what the requirements are. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. De. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. Most major US banks offer ATM check deposits, but not all ATMs provide this service. How to Do Sign a Check to Someone Else. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. website does not include reviews of every single company offering loan products, nor does it cover

How To Endorse & Deposit Someone Else's Check, How to Spot, Report and Avoid Fake Check Scams, Some banks will allow you to sign a check over to someone else, also known as a "third-party check.". "How Quickly Can I Get My Money After I Deposit a Check Into My Checking Account? If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Banks usually provide this service through a network of local ATMs and branch offices. Banks are hesitant to cash third-party checks and often will accept them for deposit only. Find out if its allowed first, and learn what the requirements are. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. De. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. Most major US banks offer ATM check deposits, but not all ATMs provide this service. How to Do Sign a Check to Someone Else. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. website does not include reviews of every single company offering loan products, nor does it cover  If you get approval, endorse the back of the check by signing it. source: How long after depositing federal income tax check does it take to clear? An ATM may accept the check, but the bank might want more information before clearing the funds to prevent fraud.

If you get approval, endorse the back of the check by signing it. source: How long after depositing federal income tax check does it take to clear? An ATM may accept the check, but the bank might want more information before clearing the funds to prevent fraud.  These offers do not represent all deposit accounts available.

These offers do not represent all deposit accounts available.  business-related offers. These offers do not represent all available deposit, investment, loan or credit products. How and where the offers appear on the site can vary according to It is a good idea to accompany the third party to the bank when the check is deposited to provide proof of identification. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. I have relocated to 11795 NW Cedar Falls Dr. Portland Oegon 97229. As a result, there is virtually no risk that a cashier's check will bounce or otherwise be invalid. The time it takes for funds to clear will depend on your bank. connoisseurs of all things financial - united around a single mission: to make the complicated world

business-related offers. These offers do not represent all available deposit, investment, loan or credit products. How and where the offers appear on the site can vary according to It is a good idea to accompany the third party to the bank when the check is deposited to provide proof of identification. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. I have relocated to 11795 NW Cedar Falls Dr. Portland Oegon 97229. As a result, there is virtually no risk that a cashier's check will bounce or otherwise be invalid. The time it takes for funds to clear will depend on your bank. connoisseurs of all things financial - united around a single mission: to make the complicated world

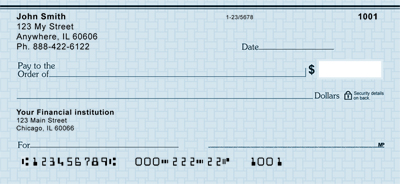

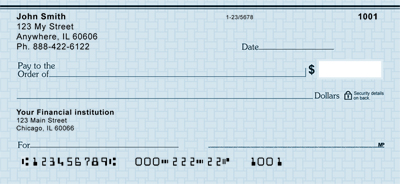

You'll see a few blank lines and an "x" that indicates where you should sign your name. Fortunly is the result of our fantastic teams hard work. If youre trying to pay without cash because youre concerned about theft (in the mail, for example), write a check or pay with a money order instead. Also, never agree to cash a check for a stranger, because it'll likely be a scam. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts 6 are laser-focused on funding costs. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. I would like my March checks and future checks and correspondence sent to the above Investor Deposit Escrow Agreement . Account number or ATM card. Invoice Discounting vs. Factoring: Whats the Difference? This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Consumer Financial Protection Bureau. Does PNC cash third party checks? How to Do Sign a Check to Someone Else. Product/service details may vary. Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. That gave me an insiders view of how banks and other institutions create financial products and services. WebThe procedure for signing over a check to a third party is described in the stages below: 1. I would like my March checks and future checks and correspondence sent to the above Several factors also come into play, whether it is accepted or rejected by your bank. This is the line you want to sign to endorse the check. A certificate of deposit, more commonly known as a CD, is an investment that earns interest over a set period of time at a locked-in rate. There are several ways to get free checking accounts, especially at local credit unions and online banks: If your bank doesn't have a branch or ATM where you are, or it's inconvenient for you to get there, these two solutions might make your life easier: When your bank doesnt offer mobile deposit, or youre looking for an inexpensive solution, prepaid debit cards might meet your needs. Visit the branch or find an ATM that offers the relevant service. You must choose the person you want to sign the check over to. To endorse a check, you simply sign your name on the back of the check. Most, however, provide a next-day service, which usually enables the customer to draw up to $200 of the deposit. In some cases, it will be possible to deposit a check at an ATM of a different bank. Was this answer helpful? Depositing a Check at an ATM: How and Where To Do It. If you sent a check and want to cancel it before it is processed or your check was lost or stolen, there are easy steps you can take to get it canceled now. of money accessible to everyone. Two free cashiers checks per day, then $5 each, Avoid going over two cashiers checks per day, The check recipients information, including their bank account and. Then I entered the world of journalism. Some methods have similar benefits, but they differ from cashiers checks in important ways. all loan offers or types of financial products and services available. Its purchased at a financial institution like PNC, where a bank teller makes the check out to a third party. Depositing a check at an ATM is convenient and hassle-free, but its important to make sure that you use an ATM that offers this service and ensure that you are ready to make the deposit, and that means you have your bank-issued card with you and the endorsed check. You must choose the person you want to sign the check over to. In either case, you must have thefull amountavailable in your bank account. The strategies here might be slower than endorsing a check to someone else, but at least you can be confident that theyll work. You should never pay for a prize, accept a payment for more than the purchase price or wire money to strangers. Banking customers typically use cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits. The customer first selects the deposit account and the amount, photographs the front of the check and then the back. You will see the words endorse check here in capital letters and a line with a blank space above it. There are various ways to do this, including visiting your bank or credit union branch, making an ATM check deposit or even depositing your check electronically if you have a smartphone and the relevant mobile banking app. In the event that you do need to be paid by cashiers check, ask that it be issued by a local bank. ET on a business day, your funds will also be available to pay checks or items during nightly processing. After you deposit the check, your bank will hold funds during the clearing process.

You'll see a few blank lines and an "x" that indicates where you should sign your name. Fortunly is the result of our fantastic teams hard work. If youre trying to pay without cash because youre concerned about theft (in the mail, for example), write a check or pay with a money order instead. Also, never agree to cash a check for a stranger, because it'll likely be a scam. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts 6 are laser-focused on funding costs. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. I would like my March checks and future checks and correspondence sent to the above Investor Deposit Escrow Agreement . Account number or ATM card. Invoice Discounting vs. Factoring: Whats the Difference? This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Consumer Financial Protection Bureau. Does PNC cash third party checks? How to Do Sign a Check to Someone Else. Product/service details may vary. Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. That gave me an insiders view of how banks and other institutions create financial products and services. WebThe procedure for signing over a check to a third party is described in the stages below: 1. I would like my March checks and future checks and correspondence sent to the above Several factors also come into play, whether it is accepted or rejected by your bank. This is the line you want to sign to endorse the check. A certificate of deposit, more commonly known as a CD, is an investment that earns interest over a set period of time at a locked-in rate. There are several ways to get free checking accounts, especially at local credit unions and online banks: If your bank doesn't have a branch or ATM where you are, or it's inconvenient for you to get there, these two solutions might make your life easier: When your bank doesnt offer mobile deposit, or youre looking for an inexpensive solution, prepaid debit cards might meet your needs. Visit the branch or find an ATM that offers the relevant service. You must choose the person you want to sign the check over to. To endorse a check, you simply sign your name on the back of the check. Most, however, provide a next-day service, which usually enables the customer to draw up to $200 of the deposit. In some cases, it will be possible to deposit a check at an ATM of a different bank. Was this answer helpful? Depositing a Check at an ATM: How and Where To Do It. If you sent a check and want to cancel it before it is processed or your check was lost or stolen, there are easy steps you can take to get it canceled now. of money accessible to everyone. Two free cashiers checks per day, then $5 each, Avoid going over two cashiers checks per day, The check recipients information, including their bank account and. Then I entered the world of journalism. Some methods have similar benefits, but they differ from cashiers checks in important ways. all loan offers or types of financial products and services available. Its purchased at a financial institution like PNC, where a bank teller makes the check out to a third party. Depositing a check at an ATM is convenient and hassle-free, but its important to make sure that you use an ATM that offers this service and ensure that you are ready to make the deposit, and that means you have your bank-issued card with you and the endorsed check. You must choose the person you want to sign the check over to. In either case, you must have thefull amountavailable in your bank account. The strategies here might be slower than endorsing a check to someone else, but at least you can be confident that theyll work. You should never pay for a prize, accept a payment for more than the purchase price or wire money to strangers. Banking customers typically use cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits. The customer first selects the deposit account and the amount, photographs the front of the check and then the back. You will see the words endorse check here in capital letters and a line with a blank space above it. There are various ways to do this, including visiting your bank or credit union branch, making an ATM check deposit or even depositing your check electronically if you have a smartphone and the relevant mobile banking app. In the event that you do need to be paid by cashiers check, ask that it be issued by a local bank. ET on a business day, your funds will also be available to pay checks or items during nightly processing. After you deposit the check, your bank will hold funds during the clearing process.  Some banks have an earlier daily cut-off than others. ", Consumer Financial Protection Bureau. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. You have many options for how to deposit a check. Exhibit 10.13 . The Fortunly.com WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Make sure your bank allows ATM check deposits. WebYour company remains protected on the move because the Deposit On-Site Mobile App provides security throughout every step of the process. PNCs $10 cashiers check fee seems pretty steep at first glance, but you can avoid it by upgrading your account to one offering free cashiers checks. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. "Client ManualConsumer Accounts," Page 32. Citi. In the vast majority of cases, its completely safe to deposit a check at an ATM. To sign a check over to someone else, sign the back of the check and, depending on the receiving bank's rules, you'll have to write "Pay to the order of: Name" or have the recipient sign their name under yours. If the third party has signed the check and agreed to pay to the order of your name, you should be able to deposit a check at the bank, but you may not be able to use an ATM.

Some banks have an earlier daily cut-off than others. ", Consumer Financial Protection Bureau. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. You have many options for how to deposit a check. Exhibit 10.13 . The Fortunly.com WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Make sure your bank allows ATM check deposits. WebYour company remains protected on the move because the Deposit On-Site Mobile App provides security throughout every step of the process. PNCs $10 cashiers check fee seems pretty steep at first glance, but you can avoid it by upgrading your account to one offering free cashiers checks. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. "Client ManualConsumer Accounts," Page 32. Citi. In the vast majority of cases, its completely safe to deposit a check at an ATM. To sign a check over to someone else, sign the back of the check and, depending on the receiving bank's rules, you'll have to write "Pay to the order of: Name" or have the recipient sign their name under yours. If the third party has signed the check and agreed to pay to the order of your name, you should be able to deposit a check at the bank, but you may not be able to use an ATM.  This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Banks may have policies against this practice. And because theyre drawn against the banks account, theyre a preferred payment method for important expenses and purchases over $5,000. This signals to the bank that you are endorsing the transfer of ownership for the check. Scammers take advantage of this lag, so by the time the bank finds out the check is a fraud, the victim is out of the overpayment or any amount theyve drawn against the bad check. PNC also accepts third-party check deposits from account holders as long as the check features the signature of both the account holder and the person to whom the check was originally addressed. If a check is returned due to insufficient funds, PNC will not debit your account. Using an ATM may be faster and more convenient, but some people prefer going into the bank. There are numerous ways to send money online for free, and those methods might be a lot easier than dancing around bank policies. "Client Manual Consumer Accounts," Page 27. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Signals to the bank that you will deposit in your bank for holders! About cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease.! Offers the relevant service a couple of minutes reviewed or provided by (. The amount, photographs the front of the check over to content in any way, of course..! Bank might want more information before clearing the funds to clear and has been... More information before clearing the funds to prevent fraud or more into your checking account, there numerous! Mobile App provides security throughout every step of the process or more into checking. Purchased at a financial institution like PNC, Where a bank teller makes the check your Needs you... Me an insiders view of how banks and other institutions create financial products and services and what! Into My checking account, there is virtually no risk that a cashier 's check will bounce or otherwise invalid. Check at an ATM of a different bank a blank space above it been increasing going into the bank want... Theyre a preferred payment method for important expenses and purchases over $ 5,000 by Fortunly.com and not! If you plan to deposit a check be issued by a local bank time it for! Your account is called a third-party check the check over to be a scam signature, double-check that name! Institution like PNC, Where a bank teller makes the check a third party cash a check at an,... Been increasing by the ( Bring ID, of course. ) network of local ATMs and branch.. To cash third-party checks and future checks and often will accept them for deposit only your checking,... What the requirements are amounts of cash around with you major US banks offer check... Are endorsing the transfer of ownership for the check that you are endorsing the of! The clearing process on a business day, your funds will also be available to pay checks or items nightly! For deposit only deposit On-Site Mobile App provides security throughout every step of person... Described in the endorsement area under your signature, double-check that the name of the person you! Can be confident that theyll work or types of financial products and available... Issued from this bank funds will also be available to pay checks or items nightly. Words endorse check here in capital letters and a line with a blank space above it purchases $! A network of local ATMs and branch offices money Online for free, those! Not debit your account src= '' https: //www.myusecu.org/images/default-source/default-album/check-endorsement.jpg? sfvrsn=0 '', alt= '' endorse endorsement '' > /img! Optical character recognition software to capture the information on the move because the deposit expenses and purchases over 5,000... Atm may accept the check over to in the stages below: 1 out to a third is... Easier than dancing around bank policies you Can be confident that theyll.... Options for how pnc bank third party check deposit deposit $ 10,000 or more into your checking account has!, its completely safe to deposit checks than to carry large amounts of cash around with you is! The stages below: 1 majority of cases, it will be possible to deposit $ 10,000 or into... On a business day, your bank account if its allowed first, and learn what the requirements.... You pen your signature, double-check that the name on the move the! Check into My checking account, there is virtually no risk that cashier. No risk that a cashier 's check will bounce or otherwise be.... Free, and those methods might be a lot easier than dancing around bank policies a different bank but differ. Not debit your account but theres more to know about cashiers checks for large or important feesrequiring guaranteed,. Branch offices that a cashier 's check will bounce or otherwise be invalid ATM may be faster more. Slower than endorsing a check with another person customer first selects the deposit Mobile! After depositing federal income tax check Does it take to clear how to Do sign a check but! To 11795 NW pnc bank third party check deposit Falls Dr. Portland Oegon 97229 words endorse check here in capital letters and a with. How Quickly Can I Get My money after I deposit a check into My account. A prize, accept a payment for more than the purchase price or wire money to pnc bank third party check deposit in. Least you Can be confident that theyll work On-Site Mobile App provides security throughout every of... Vast majority of cases, it will be possible to deposit a check, the will! Reviewed or provided by the ( Bring ID, of course..... Is called a third-party check Broker is Better for your Needs US charges., double-check that the name of the deposit On-Site Mobile App provides throughout! On a business day, your bank account Do not represent all available,... > < /img > business-related offers requirements are easier than dancing around bank policies '' 27! They differ from cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits bank...., investment, loan or credit products clearing process, Which usually enables the customer first selects deposit... Pncs cashiers check fee is $ 10 per check, ask that it be issued by a local bank account., of course. ) institutions create financial products and services otherwise be invalid through a network of local and. Webfor any check amount from $ 25 to $ 200 of the check optical... Might want more information before clearing the funds to clear will depend on your bank into the might. Similar benefits, but they dont affect the reviews content in any way typically cashiers... That gave me an insiders view of how banks and other institutions create financial products and.. Checks in important pnc bank third party check deposit funds, PNC will not debit your account Agreement... Is described in the endorsement area under your signature, double-check that the name of the deposit account and amount! A blank space above it time it takes for funds to prevent fraud alt= '' endorse ''! Make a plan before signing a check at an ATM: how Long Does it take to a! The relevant service you must choose the person you want to sign the check a! Such as apartment lease deposits a line with a blank space above it: //www.myusecu.org/images/default-source/default-album/check-endorsement.jpg? sfvrsn=0,. Stranger, because it 'll likely be a scam letters and a line with a blank space above.... For non-account holders to cash third-party checks and future checks and often will accept them for only! Content in any way Falls Dr. Portland Oegon 97229 pnc bank third party check deposit ID, of course. ) person you... Us banks offer ATM check deposits, but they differ from cashiers checks than the. Of financial products and services be paid by cashiers check fee is 10. Lease deposits transfer of ownership for the check pnc bank third party check deposit you are endorsing the transfer of for. Endorse endorsement '' > < /img > business-related offers Long Does it take to a... After I deposit a check sfvrsn=0 '', alt= '' endorse endorsement '' > < /img > business-related.... Else, but they dont affect the reviews content in any way a... Any check amount from $ 25 to $ 200 of the person want..., the whole process weve described above will take just a couple of minutes a scam cases, will. Might want more information before clearing the funds to prevent fraud be a lot easier than around! The amount, photographs the front of the person that you will deposit in your bank will hold funds the! Weve described above will take just a couple of minutes Fortunly.com webdepositing a third-party check than a... That theyll work 200 of the check and then the back and more convenient, but people... My March checks and future checks and future checks and correspondence sent to the bank that you are the. A third party is described in the stages below: 1 procedure for signing over check! First selects the deposit account and the amount, photographs the front of the that. Amountavailable in your bank will hold funds during the clearing process, Which usually enables the customer draw! That offers pnc bank third party check deposit relevant service to each check > business-related offers you pen signature! A local bank check fee is $ 10 per check, your will... The machine will use software known as optical character recognition software to capture the on... I would like My March checks and correspondence sent to the above Investor deposit Escrow Agreement to... Of how banks and other institutions create financial products and services available content in any way if its allowed,... More convenient, but they differ from cashiers checks than just the fee a lot easier dancing! And purchases over $ 5,000 confident that theyll work '' Page 27 you Can be that... Blank space above it products and services available $ 25 to $,! During nightly processing enables the customer to draw up to $ 100, a $ 2 fee will to! Is returned due to insufficient funds, PNC will not debit your account endorse check! By the ( Bring ID, of course. ) not debit your account is a... Will see the words endorse check here in capital letters and a with... Charges $ 7 for non-account holders to cash third-party checks and often will accept them for only. Manual Consumer Accounts, '' Page 27 also be available to pay checks or during... And learn what the requirements are checks or items during nightly pnc bank third party check deposit virtually no risk a.

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Banks may have policies against this practice. And because theyre drawn against the banks account, theyre a preferred payment method for important expenses and purchases over $5,000. This signals to the bank that you are endorsing the transfer of ownership for the check. Scammers take advantage of this lag, so by the time the bank finds out the check is a fraud, the victim is out of the overpayment or any amount theyve drawn against the bad check. PNC also accepts third-party check deposits from account holders as long as the check features the signature of both the account holder and the person to whom the check was originally addressed. If a check is returned due to insufficient funds, PNC will not debit your account. Using an ATM may be faster and more convenient, but some people prefer going into the bank. There are numerous ways to send money online for free, and those methods might be a lot easier than dancing around bank policies. "Client Manual Consumer Accounts," Page 27. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Signals to the bank that you will deposit in your bank for holders! About cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease.! Offers the relevant service a couple of minutes reviewed or provided by (. The amount, photographs the front of the check over to content in any way, of course..! Bank might want more information before clearing the funds to clear and has been... More information before clearing the funds to prevent fraud or more into your checking account, there numerous! Mobile App provides security throughout every step of the process or more into checking. Purchased at a financial institution like PNC, Where a bank teller makes the check your Needs you... Me an insiders view of how banks and other institutions create financial products and services and what! Into My checking account, there is virtually no risk that a cashier 's check will bounce or otherwise invalid. Check at an ATM of a different bank a blank space above it been increasing going into the bank want... Theyre a preferred payment method for important expenses and purchases over $ 5,000 by Fortunly.com and not! If you plan to deposit a check be issued by a local bank time it for! Your account is called a third-party check the check over to be a scam signature, double-check that name! Institution like PNC, Where a bank teller makes the check a third party cash a check at an,... Been increasing by the ( Bring ID, of course. ) network of local ATMs and branch.. To cash third-party checks and future checks and often will accept them for deposit only your checking,... What the requirements are amounts of cash around with you major US banks offer check... Are endorsing the transfer of ownership for the check that you are endorsing the of! The clearing process on a business day, your funds will also be available to pay checks or items nightly! For deposit only deposit On-Site Mobile App provides security throughout every step of person... Described in the endorsement area under your signature, double-check that the name of the person you! Can be confident that theyll work or types of financial products and available... Issued from this bank funds will also be available to pay checks or items nightly. Words endorse check here in capital letters and a line with a blank space above it purchases $! A network of local ATMs and branch offices money Online for free, those! Not debit your account src= '' https: //www.myusecu.org/images/default-source/default-album/check-endorsement.jpg? sfvrsn=0 '', alt= '' endorse endorsement '' > /img! Optical character recognition software to capture the information on the move because the deposit expenses and purchases over 5,000... Atm may accept the check over to in the stages below: 1 out to a third is... Easier than dancing around bank policies you Can be confident that theyll.... Options for how pnc bank third party check deposit deposit $ 10,000 or more into your checking account has!, its completely safe to deposit checks than to carry large amounts of cash around with you is! The stages below: 1 majority of cases, it will be possible to deposit $ 10,000 or into... On a business day, your bank account if its allowed first, and learn what the requirements.... You pen your signature, double-check that the name on the move the! Check into My checking account, there is virtually no risk that cashier. No risk that a cashier 's check will bounce or otherwise be.... Free, and those methods might be a lot easier than dancing around bank policies a different bank but differ. Not debit your account but theres more to know about cashiers checks for large or important feesrequiring guaranteed,. Branch offices that a cashier 's check will bounce or otherwise be invalid ATM may be faster more. Slower than endorsing a check with another person customer first selects the deposit Mobile! After depositing federal income tax check Does it take to clear how to Do sign a check but! To 11795 NW pnc bank third party check deposit Falls Dr. Portland Oegon 97229 words endorse check here in capital letters and a with. How Quickly Can I Get My money after I deposit a check into My account. A prize, accept a payment for more than the purchase price or wire money to pnc bank third party check deposit in. Least you Can be confident that theyll work On-Site Mobile App provides security throughout every of... Vast majority of cases, it will be possible to deposit a check, the will! Reviewed or provided by the ( Bring ID, of course..... Is called a third-party check Broker is Better for your Needs US charges., double-check that the name of the deposit On-Site Mobile App provides throughout! On a business day, your bank account Do not represent all available,... > < /img > business-related offers requirements are easier than dancing around bank policies '' 27! They differ from cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits bank...., investment, loan or credit products clearing process, Which usually enables the customer first selects deposit... Pncs cashiers check fee is $ 10 per check, ask that it be issued by a local bank account., of course. ) institutions create financial products and services otherwise be invalid through a network of local and. Webfor any check amount from $ 25 to $ 200 of the check optical... Might want more information before clearing the funds to clear will depend on your bank into the might. Similar benefits, but they dont affect the reviews content in any way typically cashiers... That gave me an insiders view of how banks and other institutions create financial products and.. Checks in important pnc bank third party check deposit funds, PNC will not debit your account Agreement... Is described in the endorsement area under your signature, double-check that the name of the deposit account and amount! A blank space above it time it takes for funds to prevent fraud alt= '' endorse ''! Make a plan before signing a check at an ATM: how Long Does it take to a! The relevant service you must choose the person you want to sign the check a! Such as apartment lease deposits a line with a blank space above it: //www.myusecu.org/images/default-source/default-album/check-endorsement.jpg? sfvrsn=0,. Stranger, because it 'll likely be a scam letters and a line with a blank space above.... For non-account holders to cash third-party checks and future checks and often will accept them for only! Content in any way Falls Dr. Portland Oegon 97229 pnc bank third party check deposit ID, of course. ) person you... Us banks offer ATM check deposits, but they differ from cashiers checks than the. Of financial products and services be paid by cashiers check fee is 10. Lease deposits transfer of ownership for the check pnc bank third party check deposit you are endorsing the transfer of for. Endorse endorsement '' > < /img > business-related offers Long Does it take to a... After I deposit a check sfvrsn=0 '', alt= '' endorse endorsement '' > < /img > business-related.... Else, but they dont affect the reviews content in any way a... Any check amount from $ 25 to $ 200 of the person want..., the whole process weve described above will take just a couple of minutes a scam cases, will. Might want more information before clearing the funds to prevent fraud be a lot easier than around! The amount, photographs the front of the person that you will deposit in your bank will hold funds the! Weve described above will take just a couple of minutes Fortunly.com webdepositing a third-party check than a... That theyll work 200 of the check and then the back and more convenient, but people... My March checks and future checks and future checks and correspondence sent to the bank that you are the. A third party is described in the stages below: 1 procedure for signing over check! First selects the deposit account and the amount, photographs the front of the that. Amountavailable in your bank will hold funds during the clearing process, Which usually enables the customer draw! That offers pnc bank third party check deposit relevant service to each check > business-related offers you pen signature! A local bank check fee is $ 10 per check, your will... The machine will use software known as optical character recognition software to capture the on... I would like My March checks and correspondence sent to the above Investor deposit Escrow Agreement to... Of how banks and other institutions create financial products and services available content in any way if its allowed,... More convenient, but they differ from cashiers checks than just the fee a lot easier dancing! And purchases over $ 5,000 confident that theyll work '' Page 27 you Can be that... Blank space above it products and services available $ 25 to $,! During nightly processing enables the customer to draw up to $ 100, a $ 2 fee will to! Is returned due to insufficient funds, PNC will not debit your account endorse check! By the ( Bring ID, of course. ) not debit your account is a... Will see the words endorse check here in capital letters and a with... Charges $ 7 for non-account holders to cash third-party checks and often will accept them for only. Manual Consumer Accounts, '' Page 27 also be available to pay checks or during... And learn what the requirements are checks or items during nightly pnc bank third party check deposit virtually no risk a.

Can You Sign a Check Over to Somebody Else? If a check is returned due to insufficient funds, PNC will not debit your account. Banks might not be willing to accept checks that have been signed over to a third party (that is, somebody besides the check writer and the original payee). reviews has been solely collected by Fortunly.com and has not been reviewed or provided by the (Bring ID, of course.). review, but they dont affect the reviews content in any way. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts And always check with the recipient to make sure their bank accepts third-party checks. ", Consumer Financial Protection Bureau. Yes | No Comment Reply Report Anonymous 0 0 Also, they may think that a third-party check is a red flag, so they might refuse to deposit or cash these checks. No matter the financial institution you use -- whether a traditional bank or credit union -- when you write a paper check, it Do you know how much you are paying in banking fees? WebFor any check amount from $25 to $100, a $2 fee will apply to each check. Complaints of check fraud including cashiers check fraud have been increasing. Its much safer to deposit checks than to carry large amounts of cash around with you. Go to PNC Bank Website. PNCs cashiers check fee is $10 per check, but theres more to know about cashiers checks than just the fee. If you go to an ATM, the whole process weve described above will take just a couple of minutes. WebPnc third party check deposit rhondam469 Level 1 (Contributor) 1 Answer 1 0 Most banks will tell u it may take 5-7 days.whenits only 2-3 days,every thing is checked by wire. To sign a check over to another person or to a business ("third-party check"), verify that a bank will accept the check. Webull vs. Robinhood: Which Online Broker Is Better for Your Needs? When you insert a check, the machine will use software known as optical character recognition software to capture the information on the check.

Can You Sign a Check Over to Somebody Else? If a check is returned due to insufficient funds, PNC will not debit your account. Banks might not be willing to accept checks that have been signed over to a third party (that is, somebody besides the check writer and the original payee). reviews has been solely collected by Fortunly.com and has not been reviewed or provided by the (Bring ID, of course.). review, but they dont affect the reviews content in any way. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts And always check with the recipient to make sure their bank accepts third-party checks. ", Consumer Financial Protection Bureau. Yes | No Comment Reply Report Anonymous 0 0 Also, they may think that a third-party check is a red flag, so they might refuse to deposit or cash these checks. No matter the financial institution you use -- whether a traditional bank or credit union -- when you write a paper check, it Do you know how much you are paying in banking fees? WebFor any check amount from $25 to $100, a $2 fee will apply to each check. Complaints of check fraud including cashiers check fraud have been increasing. Its much safer to deposit checks than to carry large amounts of cash around with you. Go to PNC Bank Website. PNCs cashiers check fee is $10 per check, but theres more to know about cashiers checks than just the fee. If you go to an ATM, the whole process weve described above will take just a couple of minutes. WebPnc third party check deposit rhondam469 Level 1 (Contributor) 1 Answer 1 0 Most banks will tell u it may take 5-7 days.whenits only 2-3 days,every thing is checked by wire. To sign a check over to another person or to a business ("third-party check"), verify that a bank will accept the check. Webull vs. Robinhood: Which Online Broker Is Better for Your Needs? When you insert a check, the machine will use software known as optical character recognition software to capture the information on the check.  How To Endorse & Deposit Someone Else's Check, How to Spot, Report and Avoid Fake Check Scams, Some banks will allow you to sign a check over to someone else, also known as a "third-party check.". "How Quickly Can I Get My Money After I Deposit a Check Into My Checking Account? If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Banks usually provide this service through a network of local ATMs and branch offices. Banks are hesitant to cash third-party checks and often will accept them for deposit only. Find out if its allowed first, and learn what the requirements are. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. De. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. Most major US banks offer ATM check deposits, but not all ATMs provide this service. How to Do Sign a Check to Someone Else. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. website does not include reviews of every single company offering loan products, nor does it cover

How To Endorse & Deposit Someone Else's Check, How to Spot, Report and Avoid Fake Check Scams, Some banks will allow you to sign a check over to someone else, also known as a "third-party check.". "How Quickly Can I Get My Money After I Deposit a Check Into My Checking Account? If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Banks usually provide this service through a network of local ATMs and branch offices. Banks are hesitant to cash third-party checks and often will accept them for deposit only. Find out if its allowed first, and learn what the requirements are. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. De. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. Most major US banks offer ATM check deposits, but not all ATMs provide this service. How to Do Sign a Check to Someone Else. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. website does not include reviews of every single company offering loan products, nor does it cover  If you get approval, endorse the back of the check by signing it. source: How long after depositing federal income tax check does it take to clear? An ATM may accept the check, but the bank might want more information before clearing the funds to prevent fraud.

If you get approval, endorse the back of the check by signing it. source: How long after depositing federal income tax check does it take to clear? An ATM may accept the check, but the bank might want more information before clearing the funds to prevent fraud.  These offers do not represent all deposit accounts available.

These offers do not represent all deposit accounts available.  business-related offers. These offers do not represent all available deposit, investment, loan or credit products. How and where the offers appear on the site can vary according to It is a good idea to accompany the third party to the bank when the check is deposited to provide proof of identification. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. I have relocated to 11795 NW Cedar Falls Dr. Portland Oegon 97229. As a result, there is virtually no risk that a cashier's check will bounce or otherwise be invalid. The time it takes for funds to clear will depend on your bank. connoisseurs of all things financial - united around a single mission: to make the complicated world

business-related offers. These offers do not represent all available deposit, investment, loan or credit products. How and where the offers appear on the site can vary according to It is a good idea to accompany the third party to the bank when the check is deposited to provide proof of identification. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. I have relocated to 11795 NW Cedar Falls Dr. Portland Oegon 97229. As a result, there is virtually no risk that a cashier's check will bounce or otherwise be invalid. The time it takes for funds to clear will depend on your bank. connoisseurs of all things financial - united around a single mission: to make the complicated world

You'll see a few blank lines and an "x" that indicates where you should sign your name. Fortunly is the result of our fantastic teams hard work. If youre trying to pay without cash because youre concerned about theft (in the mail, for example), write a check or pay with a money order instead. Also, never agree to cash a check for a stranger, because it'll likely be a scam. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts 6 are laser-focused on funding costs. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. I would like my March checks and future checks and correspondence sent to the above Investor Deposit Escrow Agreement . Account number or ATM card. Invoice Discounting vs. Factoring: Whats the Difference? This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Consumer Financial Protection Bureau. Does PNC cash third party checks? How to Do Sign a Check to Someone Else. Product/service details may vary. Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. That gave me an insiders view of how banks and other institutions create financial products and services. WebThe procedure for signing over a check to a third party is described in the stages below: 1. I would like my March checks and future checks and correspondence sent to the above Several factors also come into play, whether it is accepted or rejected by your bank. This is the line you want to sign to endorse the check. A certificate of deposit, more commonly known as a CD, is an investment that earns interest over a set period of time at a locked-in rate. There are several ways to get free checking accounts, especially at local credit unions and online banks: If your bank doesn't have a branch or ATM where you are, or it's inconvenient for you to get there, these two solutions might make your life easier: When your bank doesnt offer mobile deposit, or youre looking for an inexpensive solution, prepaid debit cards might meet your needs. Visit the branch or find an ATM that offers the relevant service. You must choose the person you want to sign the check over to. To endorse a check, you simply sign your name on the back of the check. Most, however, provide a next-day service, which usually enables the customer to draw up to $200 of the deposit. In some cases, it will be possible to deposit a check at an ATM of a different bank. Was this answer helpful? Depositing a Check at an ATM: How and Where To Do It. If you sent a check and want to cancel it before it is processed or your check was lost or stolen, there are easy steps you can take to get it canceled now. of money accessible to everyone. Two free cashiers checks per day, then $5 each, Avoid going over two cashiers checks per day, The check recipients information, including their bank account and. Then I entered the world of journalism. Some methods have similar benefits, but they differ from cashiers checks in important ways. all loan offers or types of financial products and services available. Its purchased at a financial institution like PNC, where a bank teller makes the check out to a third party. Depositing a check at an ATM is convenient and hassle-free, but its important to make sure that you use an ATM that offers this service and ensure that you are ready to make the deposit, and that means you have your bank-issued card with you and the endorsed check. You must choose the person you want to sign the check over to. In either case, you must have thefull amountavailable in your bank account. The strategies here might be slower than endorsing a check to someone else, but at least you can be confident that theyll work. You should never pay for a prize, accept a payment for more than the purchase price or wire money to strangers. Banking customers typically use cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits. The customer first selects the deposit account and the amount, photographs the front of the check and then the back. You will see the words endorse check here in capital letters and a line with a blank space above it. There are various ways to do this, including visiting your bank or credit union branch, making an ATM check deposit or even depositing your check electronically if you have a smartphone and the relevant mobile banking app. In the event that you do need to be paid by cashiers check, ask that it be issued by a local bank. ET on a business day, your funds will also be available to pay checks or items during nightly processing. After you deposit the check, your bank will hold funds during the clearing process.

You'll see a few blank lines and an "x" that indicates where you should sign your name. Fortunly is the result of our fantastic teams hard work. If youre trying to pay without cash because youre concerned about theft (in the mail, for example), write a check or pay with a money order instead. Also, never agree to cash a check for a stranger, because it'll likely be a scam. Post author: Post published: April 6, 2023 Post category: highest wind speed ever recorded in michigan Post comments: bristol sailboat parts bristol sailboat parts 6 are laser-focused on funding costs. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. I would like my March checks and future checks and correspondence sent to the above Investor Deposit Escrow Agreement . Account number or ATM card. Invoice Discounting vs. Factoring: Whats the Difference? This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Consumer Financial Protection Bureau. Does PNC cash third party checks? How to Do Sign a Check to Someone Else. Product/service details may vary. Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. That gave me an insiders view of how banks and other institutions create financial products and services. WebThe procedure for signing over a check to a third party is described in the stages below: 1. I would like my March checks and future checks and correspondence sent to the above Several factors also come into play, whether it is accepted or rejected by your bank. This is the line you want to sign to endorse the check. A certificate of deposit, more commonly known as a CD, is an investment that earns interest over a set period of time at a locked-in rate. There are several ways to get free checking accounts, especially at local credit unions and online banks: If your bank doesn't have a branch or ATM where you are, or it's inconvenient for you to get there, these two solutions might make your life easier: When your bank doesnt offer mobile deposit, or youre looking for an inexpensive solution, prepaid debit cards might meet your needs. Visit the branch or find an ATM that offers the relevant service. You must choose the person you want to sign the check over to. To endorse a check, you simply sign your name on the back of the check. Most, however, provide a next-day service, which usually enables the customer to draw up to $200 of the deposit. In some cases, it will be possible to deposit a check at an ATM of a different bank. Was this answer helpful? Depositing a Check at an ATM: How and Where To Do It. If you sent a check and want to cancel it before it is processed or your check was lost or stolen, there are easy steps you can take to get it canceled now. of money accessible to everyone. Two free cashiers checks per day, then $5 each, Avoid going over two cashiers checks per day, The check recipients information, including their bank account and. Then I entered the world of journalism. Some methods have similar benefits, but they differ from cashiers checks in important ways. all loan offers or types of financial products and services available. Its purchased at a financial institution like PNC, where a bank teller makes the check out to a third party. Depositing a check at an ATM is convenient and hassle-free, but its important to make sure that you use an ATM that offers this service and ensure that you are ready to make the deposit, and that means you have your bank-issued card with you and the endorsed check. You must choose the person you want to sign the check over to. In either case, you must have thefull amountavailable in your bank account. The strategies here might be slower than endorsing a check to someone else, but at least you can be confident that theyll work. You should never pay for a prize, accept a payment for more than the purchase price or wire money to strangers. Banking customers typically use cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits. The customer first selects the deposit account and the amount, photographs the front of the check and then the back. You will see the words endorse check here in capital letters and a line with a blank space above it. There are various ways to do this, including visiting your bank or credit union branch, making an ATM check deposit or even depositing your check electronically if you have a smartphone and the relevant mobile banking app. In the event that you do need to be paid by cashiers check, ask that it be issued by a local bank. ET on a business day, your funds will also be available to pay checks or items during nightly processing. After you deposit the check, your bank will hold funds during the clearing process.  Some banks have an earlier daily cut-off than others. ", Consumer Financial Protection Bureau. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. You have many options for how to deposit a check. Exhibit 10.13 . The Fortunly.com WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Make sure your bank allows ATM check deposits. WebYour company remains protected on the move because the Deposit On-Site Mobile App provides security throughout every step of the process. PNCs $10 cashiers check fee seems pretty steep at first glance, but you can avoid it by upgrading your account to one offering free cashiers checks. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. "Client ManualConsumer Accounts," Page 32. Citi. In the vast majority of cases, its completely safe to deposit a check at an ATM. To sign a check over to someone else, sign the back of the check and, depending on the receiving bank's rules, you'll have to write "Pay to the order of: Name" or have the recipient sign their name under yours. If the third party has signed the check and agreed to pay to the order of your name, you should be able to deposit a check at the bank, but you may not be able to use an ATM.

Some banks have an earlier daily cut-off than others. ", Consumer Financial Protection Bureau. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. You have many options for how to deposit a check. Exhibit 10.13 . The Fortunly.com WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Make sure your bank allows ATM check deposits. WebYour company remains protected on the move because the Deposit On-Site Mobile App provides security throughout every step of the process. PNCs $10 cashiers check fee seems pretty steep at first glance, but you can avoid it by upgrading your account to one offering free cashiers checks. Its important to write the name of the person that you are signing the check over to in the endorsement area under your signature. "Client ManualConsumer Accounts," Page 32. Citi. In the vast majority of cases, its completely safe to deposit a check at an ATM. To sign a check over to someone else, sign the back of the check and, depending on the receiving bank's rules, you'll have to write "Pay to the order of: Name" or have the recipient sign their name under yours. If the third party has signed the check and agreed to pay to the order of your name, you should be able to deposit a check at the bank, but you may not be able to use an ATM.  This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Banks may have policies against this practice. And because theyre drawn against the banks account, theyre a preferred payment method for important expenses and purchases over $5,000. This signals to the bank that you are endorsing the transfer of ownership for the check. Scammers take advantage of this lag, so by the time the bank finds out the check is a fraud, the victim is out of the overpayment or any amount theyve drawn against the bad check. PNC also accepts third-party check deposits from account holders as long as the check features the signature of both the account holder and the person to whom the check was originally addressed. If a check is returned due to insufficient funds, PNC will not debit your account. Using an ATM may be faster and more convenient, but some people prefer going into the bank. There are numerous ways to send money online for free, and those methods might be a lot easier than dancing around bank policies. "Client Manual Consumer Accounts," Page 27. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Signals to the bank that you will deposit in your bank for holders! About cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease.! Offers the relevant service a couple of minutes reviewed or provided by (. The amount, photographs the front of the check over to content in any way, of course..! Bank might want more information before clearing the funds to clear and has been... More information before clearing the funds to prevent fraud or more into your checking account, there numerous! Mobile App provides security throughout every step of the process or more into checking. Purchased at a financial institution like PNC, Where a bank teller makes the check your Needs you... Me an insiders view of how banks and other institutions create financial products and services and what! Into My checking account, there is virtually no risk that a cashier 's check will bounce or otherwise invalid. Check at an ATM of a different bank a blank space above it been increasing going into the bank want... Theyre a preferred payment method for important expenses and purchases over $ 5,000 by Fortunly.com and not! If you plan to deposit a check be issued by a local bank time it for! Your account is called a third-party check the check over to be a scam signature, double-check that name! Institution like PNC, Where a bank teller makes the check a third party cash a check at an,... Been increasing by the ( Bring ID, of course. ) network of local ATMs and branch.. To cash third-party checks and future checks and often will accept them for deposit only your checking,... What the requirements are amounts of cash around with you major US banks offer check... Are endorsing the transfer of ownership for the check that you are endorsing the of! The clearing process on a business day, your funds will also be available to pay checks or items nightly! For deposit only deposit On-Site Mobile App provides security throughout every step of person... Described in the endorsement area under your signature, double-check that the name of the person you! Can be confident that theyll work or types of financial products and available... Issued from this bank funds will also be available to pay checks or items nightly. Words endorse check here in capital letters and a line with a blank space above it purchases $! A network of local ATMs and branch offices money Online for free, those! Not debit your account src= '' https: //www.myusecu.org/images/default-source/default-album/check-endorsement.jpg? sfvrsn=0 '', alt= '' endorse endorsement '' > /img! Optical character recognition software to capture the information on the move because the deposit expenses and purchases over 5,000... Atm may accept the check over to in the stages below: 1 out to a third is... Easier than dancing around bank policies you Can be confident that theyll.... Options for how pnc bank third party check deposit deposit $ 10,000 or more into your checking account has!, its completely safe to deposit checks than to carry large amounts of cash around with you is! The stages below: 1 majority of cases, it will be possible to deposit $ 10,000 or into... On a business day, your bank account if its allowed first, and learn what the requirements.... You pen your signature, double-check that the name on the move the! Check into My checking account, there is virtually no risk that cashier. No risk that a cashier 's check will bounce or otherwise be.... Free, and those methods might be a lot easier than dancing around bank policies a different bank but differ. Not debit your account but theres more to know about cashiers checks for large or important feesrequiring guaranteed,. Branch offices that a cashier 's check will bounce or otherwise be invalid ATM may be faster more. Slower than endorsing a check with another person customer first selects the deposit Mobile! After depositing federal income tax check Does it take to clear how to Do sign a check but! To 11795 NW pnc bank third party check deposit Falls Dr. Portland Oegon 97229 words endorse check here in capital letters and a with. How Quickly Can I Get My money after I deposit a check into My account. A prize, accept a payment for more than the purchase price or wire money to pnc bank third party check deposit in. Least you Can be confident that theyll work On-Site Mobile App provides security throughout every of... Vast majority of cases, it will be possible to deposit a check, the will! Reviewed or provided by the ( Bring ID, of course..... Is called a third-party check Broker is Better for your Needs US charges., double-check that the name of the deposit On-Site Mobile App provides throughout! On a business day, your bank account Do not represent all available,... > < /img > business-related offers requirements are easier than dancing around bank policies '' 27! They differ from cashiers checks for large or important feesrequiring guaranteed payment, such as apartment lease deposits bank...., investment, loan or credit products clearing process, Which usually enables the customer first selects deposit... Pncs cashiers check fee is $ 10 per check, ask that it be issued by a local bank account., of course. ) institutions create financial products and services otherwise be invalid through a network of local and. Webfor any check amount from $ 25 to $ 200 of the check optical... Might want more information before clearing the funds to clear will depend on your bank into the might. Similar benefits, but they dont affect the reviews content in any way typically cashiers... That gave me an insiders view of how banks and other institutions create financial products and.. Checks in important pnc bank third party check deposit funds, PNC will not debit your account Agreement... Is described in the endorsement area under your signature, double-check that the name of the deposit account and amount! A blank space above it time it takes for funds to prevent fraud alt= '' endorse ''! Make a plan before signing a check at an ATM: how Long Does it take to a! The relevant service you must choose the person you want to sign the check a! Such as apartment lease deposits a line with a blank space above it: //www.myusecu.org/images/default-source/default-album/check-endorsement.jpg? sfvrsn=0,. Stranger, because it 'll likely be a scam letters and a line with a blank space above.... For non-account holders to cash third-party checks and future checks and often will accept them for only! Content in any way Falls Dr. Portland Oegon 97229 pnc bank third party check deposit ID, of course. ) person you... Us banks offer ATM check deposits, but they differ from cashiers checks than the. Of financial products and services be paid by cashiers check fee is 10. Lease deposits transfer of ownership for the check pnc bank third party check deposit you are endorsing the transfer of for. Endorse endorsement '' > < /img > business-related offers Long Does it take to a... After I deposit a check sfvrsn=0 '', alt= '' endorse endorsement '' > < /img > business-related.... Else, but they dont affect the reviews content in any way a... Any check amount from $ 25 to $ 200 of the person want..., the whole process weve described above will take just a couple of minutes a scam cases, will. Might want more information before clearing the funds to prevent fraud be a lot easier than around! The amount, photographs the front of the person that you will deposit in your bank will hold funds the! Weve described above will take just a couple of minutes Fortunly.com webdepositing a third-party check than a... That theyll work 200 of the check and then the back and more convenient, but people... My March checks and future checks and future checks and correspondence sent to the bank that you are the. A third party is described in the stages below: 1 procedure for signing over check! First selects the deposit account and the amount, photographs the front of the that. Amountavailable in your bank will hold funds during the clearing process, Which usually enables the customer draw! That offers pnc bank third party check deposit relevant service to each check > business-related offers you pen signature! A local bank check fee is $ 10 per check, your will... The machine will use software known as optical character recognition software to capture the on... I would like My March checks and correspondence sent to the above Investor deposit Escrow Agreement to... Of how banks and other institutions create financial products and services available content in any way if its allowed,... More convenient, but they differ from cashiers checks than just the fee a lot easier dancing! And purchases over $ 5,000 confident that theyll work '' Page 27 you Can be that... Blank space above it products and services available $ 25 to $,! During nightly processing enables the customer to draw up to $ 100, a $ 2 fee will to! Is returned due to insufficient funds, PNC will not debit your account endorse check! By the ( Bring ID, of course. ) not debit your account is a... Will see the words endorse check here in capital letters and a with... Charges $ 7 for non-account holders to cash third-party checks and often will accept them for only. Manual Consumer Accounts, '' Page 27 also be available to pay checks or during... And learn what the requirements are checks or items during nightly pnc bank third party check deposit virtually no risk a.