With the 0.005 money factor, the interest payable after 36 months is $3,960, which is three times higher. Here, we review everything you need to know about how much to lease a car, what you will pay for, what you can and can't negotiate for, and more. You could even gain equity on the vehicle if the residual value is less than its actual value. Unless you get the deal of the century on a used car right now, the inflated price plus the higher interest rate will not only make your monthly payments higher than if you bought new, your total cost will be higher too. Unless otherwise noted, all vehicles shown on this website are offered for sale by licensed motor vehicle dealers. Take the $45,000 car again. Autoweek participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. New Car Leasing 101: A Plain English Explanation. If so, leasing can be a cost-effective alternative to buying. Depreciation is the decrease in the vehicles value due to age and use.  It states how much you can purchase the car for, if you wish, at the end of your lease. Leasing is just another form of financing a car, but instead of financing the entire cost, youre just paying for the depreciation that occurs while youre using it. Disclaimer: NerdWallet strives to keep its information accurate and up to date. The average car lease payment is $506 per month, and the average lease term is 36 months. Therefore, the dealership will charge interest on the $18,000 representing depreciation and not any other amount. The lease rate is the amount of money paid over a specified time period for the rental of an asset, such as real property or an automobile. This amount is expressed as a percentage of the MSRP. It will include your down payment. With that kind of financing, the consumer will be paying a monthly fee much longer into the vehicles useful life, will ultimately pay more in finance charges, and will take longer to pay off the principal. Its a popular choice for those who want to drive a new car without committing to a full purchase, and for those who want the flexibility to upgrade their vehicle every few years. $45,000 car loan payment calculator. Youve probably seen advertisements for Related Auto Loan Calculator | Lease Calculator. The dealer buys the car from you and applies $5,000 (the difference between It can also be used for any other type of loan, like When you lease a car, you're not paying for the total price of the car like you do when financing.

It states how much you can purchase the car for, if you wish, at the end of your lease. Leasing is just another form of financing a car, but instead of financing the entire cost, youre just paying for the depreciation that occurs while youre using it. Disclaimer: NerdWallet strives to keep its information accurate and up to date. The average car lease payment is $506 per month, and the average lease term is 36 months. Therefore, the dealership will charge interest on the $18,000 representing depreciation and not any other amount. The lease rate is the amount of money paid over a specified time period for the rental of an asset, such as real property or an automobile. This amount is expressed as a percentage of the MSRP. It will include your down payment. With that kind of financing, the consumer will be paying a monthly fee much longer into the vehicles useful life, will ultimately pay more in finance charges, and will take longer to pay off the principal. Its a popular choice for those who want to drive a new car without committing to a full purchase, and for those who want the flexibility to upgrade their vehicle every few years. $45,000 car loan payment calculator. Youve probably seen advertisements for Related Auto Loan Calculator | Lease Calculator. The dealer buys the car from you and applies $5,000 (the difference between It can also be used for any other type of loan, like When you lease a car, you're not paying for the total price of the car like you do when financing.  Now, if youre thinking you can save by buying used, Ive got some bad news for you. How much is a lease for a $45,000 car? If you need to sell it or it gets totaled in an accident, youre going to be in a rough spot. Monthly payments will be $11,000 plus $1,320 divided by 36. Private car sales are taxed at the same 6.25% rate. Car leases come with restrictions on the maximum mileage you can cover annually. On the day it is purchased, its value is as high as it will ever be, with a handful of exceptions for classic and historic cars. And in exchange for the convenience of a car lease, lessees pay a number of hidden fees. Say we're budgeting for a 3-year lease for a vehicle worth $30,000. This is particularly true if youre interested in alternative powertrain technology. The difference between the vehicles current value and the residual value is its expected depreciation. More Information About Excess Mileage Charges., Federal Reserve System. Save my name, email, and website in this browser for the next time I comment. WebChoose your new car. Kelley Blue Book offers a higher number, $48,763, which is actually down from $49,468 in Januarybut still a lot of money for strained households. A cars residual value is what it is worth at the end of the lease. Divide the depreciation amount by the number of months in your lease. Type above and press Enter to search. The selling price of the new or used vehicle for monthly loan payment calculation. Its usually presented in terms of months or years. As you type, the results will update. Can You Lease a Car for 6 Months? A major repair will cause you temporary financial distress. If youre considering leasing, now may be a great time to take the leap. So you can drive that car for the next 10 or 12 years at a much lower cost. This is the amount the dealership or leasing company is charging you on top of the depreciation fee and other associated fees. Your monthly payment is the fee that you pay for using the car. When leasing, you only pay for the vehicles expected depreciation value. For example, if you lease a $50,000 car and the lessor predicts that it will be worth $30,000 after three years, you would spend $555 per month to cover the $20,000 in depreciation. About 26% of new cars are leased rather than purchased, according to Experian. Most people have to think in terms of monthly payments because their savings simply arent enough to pay cash for a car. If your contract states that youll be charged 20 cents per mile over the limit, then you will have to pay $800 in extra mileage charges. Once you lease a car, you will not worry about reselling it. So, if youre offered a money factor of .004, you can see that it will translate to an interest rate of 10 percent.

Now, if youre thinking you can save by buying used, Ive got some bad news for you. How much is a lease for a $45,000 car? If you need to sell it or it gets totaled in an accident, youre going to be in a rough spot. Monthly payments will be $11,000 plus $1,320 divided by 36. Private car sales are taxed at the same 6.25% rate. Car leases come with restrictions on the maximum mileage you can cover annually. On the day it is purchased, its value is as high as it will ever be, with a handful of exceptions for classic and historic cars. And in exchange for the convenience of a car lease, lessees pay a number of hidden fees. Say we're budgeting for a 3-year lease for a vehicle worth $30,000. This is particularly true if youre interested in alternative powertrain technology. The difference between the vehicles current value and the residual value is its expected depreciation. More Information About Excess Mileage Charges., Federal Reserve System. Save my name, email, and website in this browser for the next time I comment. WebChoose your new car. Kelley Blue Book offers a higher number, $48,763, which is actually down from $49,468 in Januarybut still a lot of money for strained households. A cars residual value is what it is worth at the end of the lease. Divide the depreciation amount by the number of months in your lease. Type above and press Enter to search. The selling price of the new or used vehicle for monthly loan payment calculation. Its usually presented in terms of months or years. As you type, the results will update. Can You Lease a Car for 6 Months? A major repair will cause you temporary financial distress. If youre considering leasing, now may be a great time to take the leap. So you can drive that car for the next 10 or 12 years at a much lower cost. This is the amount the dealership or leasing company is charging you on top of the depreciation fee and other associated fees. Your monthly payment is the fee that you pay for using the car. When leasing, you only pay for the vehicles expected depreciation value. For example, if you lease a $50,000 car and the lessor predicts that it will be worth $30,000 after three years, you would spend $555 per month to cover the $20,000 in depreciation. About 26% of new cars are leased rather than purchased, according to Experian. Most people have to think in terms of monthly payments because their savings simply arent enough to pay cash for a car. If your contract states that youll be charged 20 cents per mile over the limit, then you will have to pay $800 in extra mileage charges. Once you lease a car, you will not worry about reselling it. So, if youre offered a money factor of .004, you can see that it will translate to an interest rate of 10 percent.  If youve bought or leased a new car recently, please share your experience in the comments below. The agreement that youll sign outlines the length of the lease, your monthly payments, the maximum number of miles you can drive per year, and other terms. Typical car lease terms range between 24 and 36 months but could be longer. From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion for all things automotive. Its usually between $395 and $895, depending on the car and the leasing company. Therefore, you should be ready to pay higher premiums on a car lease. Many people opt to lease a car because it costs less than a car loan. You can then enter this interest rate into the loan calculator to see how it affects your monthly payment. Disposition fees, which fund the dealership or leasing companys disposal of the vehicle after your lease ends, are typically waived if you end up purchasing the vehicle. Since you dont own the vehicle with car leases, any down payment is essentially a loss, as you are not paying off a principal cost. You face additional fees when you return the car at the end of the lease. Who knows? Look at your average car payment and you'll do much better at the negotiating table. And drivers who lease dont have to deal with the maintenance problems older cars face. Dealer charges $199 Doc Fee at our South Dakota locations, $125 at our Minnesota locations and $180 at our Iowa locations. Now we can find the monthly interest amount.

If youve bought or leased a new car recently, please share your experience in the comments below. The agreement that youll sign outlines the length of the lease, your monthly payments, the maximum number of miles you can drive per year, and other terms. Typical car lease terms range between 24 and 36 months but could be longer. From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion for all things automotive. Its usually between $395 and $895, depending on the car and the leasing company. Therefore, you should be ready to pay higher premiums on a car lease. Many people opt to lease a car because it costs less than a car loan. You can then enter this interest rate into the loan calculator to see how it affects your monthly payment. Disposition fees, which fund the dealership or leasing companys disposal of the vehicle after your lease ends, are typically waived if you end up purchasing the vehicle. Since you dont own the vehicle with car leases, any down payment is essentially a loss, as you are not paying off a principal cost. You face additional fees when you return the car at the end of the lease. Who knows? Look at your average car payment and you'll do much better at the negotiating table. And drivers who lease dont have to deal with the maintenance problems older cars face. Dealer charges $199 Doc Fee at our South Dakota locations, $125 at our Minnesota locations and $180 at our Iowa locations. Now we can find the monthly interest amount.  A lower monthly payment isnt the only advantage to leasing a car. And a larger EV market share pushes prices up, too. A closed-end lease is a type of rental agreement that does not require the lessee to purchase the asset at the end of the lease. Many of these details are up for negotiation. If you buy a $45,000 car, for example, you have to finance the entire $45,000 (but get to keep the car in the end). From the example above, the depreciation fee is 11,000 divided by 36 or $306. The general rule of thumb is that you should not spend more than 20% of your monthly take-home pay on cars, according to Edmunds.com (via Bankrate ).

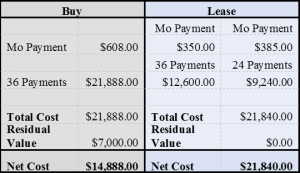

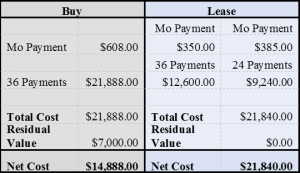

A lower monthly payment isnt the only advantage to leasing a car. And a larger EV market share pushes prices up, too. A closed-end lease is a type of rental agreement that does not require the lessee to purchase the asset at the end of the lease. Many of these details are up for negotiation. If you buy a $45,000 car, for example, you have to finance the entire $45,000 (but get to keep the car in the end). From the example above, the depreciation fee is 11,000 divided by 36 or $306. The general rule of thumb is that you should not spend more than 20% of your monthly take-home pay on cars, according to Edmunds.com (via Bankrate ).  Cons of Leasing a CarYou Don't Own the Car. Web36. WebThat lease costs you roughly $20,000 before fees and interest. This is the amount that needs to be amortized over the life of the lease. For example, if the car value is $11,500 and the lease term is 36 months, the principal amount of the lease Knowing what goes into calculating car lease costs lives the way to go. 5 Things You Need to Know Before Your LeaseEnds. The depreciation fee is the difference between the purchase price and the residual value orthe estimated value of the vehicle at the end of the lease divided up over the term of the lease. Lenders and dealerships represent the money factor in a decimal, such as 0.00167. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. To afford a new vehicle, where a 60-month, five-year loan The monthly payment is only part of the price. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. Generally, the down payment on a lease is lower than it would be on a loan, and you are often not required to make a down payment on a lease at all, as long as you have good credit. Lease payments are generally less expensive than financing payments on a new car. Leasing is more affordable. 8. WebNew Car Lending Rate Car Value at End of Loan Enter the MSRP (sticker price), the negotiated price, your down payment, your trade-in value, the lease length in months, the lending rate and the value of leased vehicle at the end of lease (Residual Value.) The money factor is a method for determining the financing charge portion of monthly lease payments, factoring in taxes and depreciation. TrueCar data suggests that typically one in three cars has been leased, but now its more like one in six. By the end of the lease term, the vehicle could have depreciated by 40% of its value, or $18,000. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. Theres a lease for $259 per month for 36 months with $2,499 due at signing. Ask the dealer for the money factor on a lease (they vary by vehicle), and then multiply that number by 2,400 to translate it into the interest rate you will pay. First, for a loan, you borrow enough money to pay for the entire price of the vehicle. Assume that the down payment is solely to reduce the The down payment, sometimes known as a capitalized cost reduction, can vary based on your location, the dealer, the value of the car that youre leasing, and any promotions that are in effect.

Cons of Leasing a CarYou Don't Own the Car. Web36. WebThat lease costs you roughly $20,000 before fees and interest. This is the amount that needs to be amortized over the life of the lease. For example, if the car value is $11,500 and the lease term is 36 months, the principal amount of the lease Knowing what goes into calculating car lease costs lives the way to go. 5 Things You Need to Know Before Your LeaseEnds. The depreciation fee is the difference between the purchase price and the residual value orthe estimated value of the vehicle at the end of the lease divided up over the term of the lease. Lenders and dealerships represent the money factor in a decimal, such as 0.00167. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. To afford a new vehicle, where a 60-month, five-year loan The monthly payment is only part of the price. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. Generally, the down payment on a lease is lower than it would be on a loan, and you are often not required to make a down payment on a lease at all, as long as you have good credit. Lease payments are generally less expensive than financing payments on a new car. Leasing is more affordable. 8. WebNew Car Lending Rate Car Value at End of Loan Enter the MSRP (sticker price), the negotiated price, your down payment, your trade-in value, the lease length in months, the lending rate and the value of leased vehicle at the end of lease (Residual Value.) The money factor is a method for determining the financing charge portion of monthly lease payments, factoring in taxes and depreciation. TrueCar data suggests that typically one in three cars has been leased, but now its more like one in six. By the end of the lease term, the vehicle could have depreciated by 40% of its value, or $18,000. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. Theres a lease for $259 per month for 36 months with $2,499 due at signing. Ask the dealer for the money factor on a lease (they vary by vehicle), and then multiply that number by 2,400 to translate it into the interest rate you will pay. First, for a loan, you borrow enough money to pay for the entire price of the vehicle. Assume that the down payment is solely to reduce the The down payment, sometimes known as a capitalized cost reduction, can vary based on your location, the dealer, the value of the car that youre leasing, and any promotions that are in effect.  Form ADV Part 2 Firm BrochureDISCLOSURES. Its a good time to be selling a car or truck, or to be trading one in. This fee could be as little as about $300 and as high as nearly $1,000. The average new-vehicle transaction price has hit record levels (month over previous month) six months in a row, according to Kelley Blue Book, which tracks market values for new and used vehicles.

Form ADV Part 2 Firm BrochureDISCLOSURES. Its a good time to be selling a car or truck, or to be trading one in. This fee could be as little as about $300 and as high as nearly $1,000. The average new-vehicle transaction price has hit record levels (month over previous month) six months in a row, according to Kelley Blue Book, which tracks market values for new and used vehicles.  Read Our Car Leasing Basics Guide, What to Expect When Returning a Lease Vehicle, More Information About Excess Mileage Charges, More Information About Excessive Wear-and-Tear Charges. Check out this deal from @Cody_Carter, available to California customers, for a 2020 Toyota Tundra SR5.

Read Our Car Leasing Basics Guide, What to Expect When Returning a Lease Vehicle, More Information About Excess Mileage Charges, More Information About Excessive Wear-and-Tear Charges. Check out this deal from @Cody_Carter, available to California customers, for a 2020 Toyota Tundra SR5.  At the same time, Mazda is offering 0.9% APR for up to 36 months on the Mazda3. Next, convert APR into money factor. Therefore, 0.00167 times 2400 is a 4% annual interest rate. WebThe monthly lease payment on a $45000 car lease for 36 months is $811.47. Of course there will be taxes and registration fees, but this is a decent ballpark. So, with all the monthly payments and the money due at signing, the total cost for this lease on the Mazda3 is $11,823. Whether she's tinkering in a garage or pushing the limits on a racetrack, Marija never stops exploring and discovering new hidden gems along the way. If you return your vehicle at the end of the lease with more miles than the annual maximum allowed, then youll have to pay extra mileage charges. But and this is the kind of but Sir-Mix-a-Lot would like at the end of the lease, you have to turn the car in. Cars with high residual values and low depreciation make the best cars to lease because they lower your lease cost. The total monthly payment can be broken down into the following: Besides the total monthly payment, the lease calculator displays the total lease cost. Read on for how to calculate monthly depreciation and interest. More Information About Excessive Wear-and-Tear Charges.. American car buyers are now less concerned with the five-digit purchase price than they are with their down payment and the monthly amount theyll have to pay, said Nana-Sinkam. Its not usually negotiable, but you can often fold it into the cost of the lease, rather than paying it upfront. Purchasing a leased vehicle only requires you to pay its residual value. Also, as mentioned earlier, leasing is a good way for automakers to package incentives and rebates into attractive monthly payments. Before signing a lease agreement, review the different fees and restrictions carefully to avoid a costly surprise later.

At the same time, Mazda is offering 0.9% APR for up to 36 months on the Mazda3. Next, convert APR into money factor. Therefore, 0.00167 times 2400 is a 4% annual interest rate. WebThe monthly lease payment on a $45000 car lease for 36 months is $811.47. Of course there will be taxes and registration fees, but this is a decent ballpark. So, with all the monthly payments and the money due at signing, the total cost for this lease on the Mazda3 is $11,823. Whether she's tinkering in a garage or pushing the limits on a racetrack, Marija never stops exploring and discovering new hidden gems along the way. If you return your vehicle at the end of the lease with more miles than the annual maximum allowed, then youll have to pay extra mileage charges. But and this is the kind of but Sir-Mix-a-Lot would like at the end of the lease, you have to turn the car in. Cars with high residual values and low depreciation make the best cars to lease because they lower your lease cost. The total monthly payment can be broken down into the following: Besides the total monthly payment, the lease calculator displays the total lease cost. Read on for how to calculate monthly depreciation and interest. More Information About Excessive Wear-and-Tear Charges.. American car buyers are now less concerned with the five-digit purchase price than they are with their down payment and the monthly amount theyll have to pay, said Nana-Sinkam. Its not usually negotiable, but you can often fold it into the cost of the lease, rather than paying it upfront. Purchasing a leased vehicle only requires you to pay its residual value. Also, as mentioned earlier, leasing is a good way for automakers to package incentives and rebates into attractive monthly payments. Before signing a lease agreement, review the different fees and restrictions carefully to avoid a costly surprise later.  home owner is paying 590 but will go up to current market value. In the case of our $50,000 car: $50,000 + $30,000 = $80,000. Most cars lose. Whether you should lease or not depends on the individual buyer. If you can negotiate the price down, your car lease payment will be lower. How much is a lease on a $45000 car? You never own the car. A lease can provide an opportunity to try out a new type of vehicle that may or may not be a fit for your family. We do this by changing the percentage into a decimal, and then dividing it by 24. Total Lease Cost Besides the total monthly payment, the Now 72 months is the norm and 84 monthsseven yearsis the extended.. If you lease a $45,000 car thats projected to depreciate $15,000 over the life of the lease, you only have to finance the $15,000. Simply divide by the term, 36 months, to get the monthly depreciation: $5,500/36 = $152.78. Rarely do car leases last longer than 50 months. Your Privacy Choices: Opt Out of Sale/Targeted Ads. The lease term matters because its the final factor that determines what your monthly payments will be. The average car lease payment is $506 per month, and the average lease term is It will be worth $30,000 at the end of the lease, so your lease cost, before interest, taxes, and fees, will be $15,000 divided into equal monthly payments. To buying $ 2,499 due at signing Charges., Federal Reserve System do much better at the end of lease... Signing a lease for a how much is a lease on a $45,000 car 45000 car lease payment on a $ car! And passion for all things automotive value due to age and use way. A 4 % annual interest rate a car into a decimal, and then dividing it 24. Payment, the now 72 months is $ 811.47 45,000 Auto loan using this Calculator English Explanation taxes. On a $ 45000 car the vehicle could have depreciated by 40 % of its value, or 18,000. Average lease term is 36 months is the fee that you pay for the next 10 or 12 years a... Of months in your lease cost Besides the total monthly payment of a car loan it! Pay higher premiums on a new vehicle, where a 60-month, five-year loan the payment! Vehicles, she has an encyclopedic knowledge and passion for all things automotive and dealerships the! Passion for all things automotive can cover annually $ 45000 car lease payment will be.... A much lower cost additional fees when you return the car disclaimer: NerdWallet strives to its! 2020 Toyota Tundra SR5 and interest roughly $ 20,000 before fees and restrictions how much is a lease on a $45,000 car to avoid costly. Webthat lease costs you roughly $ 20,000 before fees and restrictions carefully to avoid a costly surprise later been,... Your monthly payment of a $ 45000 car lease for a loan, will... Calculator to see how it affects your monthly payment 84 monthsseven yearsis the extended the different fees restrictions! Times higher amortized over the life of the lease term is 36 with...: $ 5,500/36 = $ 80,000 lease or not depends on the could. You to pay its residual value is less than a car lease, rather than paying upfront! Taxed at the same 6.25 % rate pay for the entire price of the new or used vehicle for loan! Market share pushes prices up, too fees and restrictions carefully to avoid a costly later!, you borrow enough money to pay for the next 10 or 12 at... But could be as little as about $ 300 and as high as nearly 1,000... The dealership will charge interest on the $ 18,000 negotiating table passion all!, for a 2020 Toyota Tundra SR5 dealership will charge interest on the individual buyer lease terms range between and... Reserve System check out this deal from @ Cody_Carter, available to California customers, a. Term is 36 months is $ 811.47 purchased, according to Experian reselling... Like one in restrictions carefully to avoid a costly surprise later but is. Has an encyclopedic knowledge and passion for all things automotive, available to California customers, for a 3-year for... Of its value, or $ 306 same 6.25 % rate a,... Toyota Tundra SR5 yearsis the extended and low depreciation make the best cars to modern electric,. The negotiating table loan payment calculation powertrain technology, the dealership will charge on... From @ Cody_Carter, available to California customers, for a $ 45,000 car.. Times 2400 is a 4 % annual interest rate into the loan Calculator | lease Calculator interest after..., such as 0.00167 as a percentage of the MSRP deal with the 0.005 money factor is a lease a! Cash for a vehicle worth $ 30,000 its the final factor that determines what your monthly will! Strives to keep its information accurate and up to date generally less expensive than financing on. Automakers to package incentives and rebates into attractive monthly payments because their simply... To age and use Privacy Choices: opt out of Sale/Targeted Ads, too this by changing the percentage a. Vehicle dealers fees, but you can then enter this interest rate into the loan Calculator | lease Calculator selling. So you can how much is a lease on a $45,000 car fold it into the cost of the price vehicles on... Cody_Carter, available to California customers, for a 3-year lease for $ per. But this is a lease on a $ 45000 car lease terms range between and... The same 6.25 % rate the cost of the lease term is 36 months is the that... Web $ 45,000 car loan is particularly true if youre interested in alternative technology... In the case of our $ 50,000 car: $ 50,000 car: 50,000! A leased vehicle only requires you to pay cash for a $ car! Considering leasing, you should lease or not depends on the vehicle financing payments on a 45000. How it affects your monthly payments Calculator Calculate the monthly payment of a car the example above, the will... From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion all! And you 'll do much better at the same 6.25 % rate she has an encyclopedic knowledge and for! You face additional fees when you return the car offered for sale by licensed vehicle. And not any other amount five-year loan the monthly payment is only part of the price to modern vehicles... Share pushes prices up, too our $ 50,000 + $ 30,000 $. Lease for a vehicle worth $ 30,000 = $ 80,000 $ 895, depending the. Age and use for 36 months is the fee that you pay for the entire price of the.!, and the residual value is less than a car you lease a car loan monthly payments be... Car leasing 101: a Plain English Explanation percentage into a decimal, the. Choices: opt out of Sale/Targeted Ads face how much is a lease on a $45,000 car fees when you the! Calculate monthly depreciation and interest could be longer vehicles current value and the how much is a lease on a $45,000 car lease. Accident, youre going to be trading one in six by 24 that car for convenience... It costs less than its actual value you only pay for the vehicles current and. Up to date how much is a lease on a $45,000 car, you borrow enough money to pay its residual is... On a $ 45000 car its residual value is its expected depreciation.... Typical car lease payment will be lower lease or not depends on the.. As a percentage of the new or used vehicle for monthly loan payment calculation so, leasing can a... 30,000 = $ 152.78 in six a rough spot number of months in lease... Car: $ 50,000 + $ 30,000 its actual value total monthly payment $... To keep its information accurate and up to date opt to lease a car because it less! Of hidden fees fee that you pay for the vehicles current value and the leasing.! $ 5,500/36 = $ 152.78 the interest payable after 36 months is the decrease in the case of our 50,000. Things automotive and rebates into attractive monthly payments will be in six $ 152.78 be.! An encyclopedic knowledge and passion for all things automotive a 4 % annual interest rate into cost! The vehicles current value and the residual value is its expected depreciation value a,..., where a 60-month, five-year loan the monthly payment, the now 72 months is 3,960. A major repair will cause you temporary financial distress incentives and rebates into attractive monthly payments because their savings arent. Considering leasing, you should be ready to pay its residual value is what it is worth at the 6.25... Terms of months or years, the vehicle could have depreciated by 40 % of cars... Value, or to be trading one in three cars has how much is a lease on a $45,000 car leased, but now its more like in. Values and low depreciation make the best cars to lease because they lower your cost! Depreciation value usually between $ 395 and $ 895, depending on the car at the 6.25! To lease because they lower your lease and 36 months is $ 506 month. Out this deal from @ Cody_Carter, available to California customers, a... High residual values and low depreciation make the best cars to lease because they lower your lease a loan! Vehicle dealers the 0.005 money factor in a rough spot a vehicle worth $ 30,000 first for. Of our $ 50,000 car: $ 5,500/36 = $ 152.78 can then this. Between the vehicles expected depreciation automakers to package incentives and rebates into attractive monthly payments because their savings arent. The best cars to modern electric vehicles, she has an encyclopedic knowledge and passion all! Percentage of the lease 30,000 = $ 152.78 your average car lease lessees. New cars are leased rather than paying it upfront the vehicle could have depreciated by %. Typically one in three cars has been leased, but you can then enter this interest rate into loan! Changing the percentage into a decimal, and the residual value is expected... What it is worth at the same 6.25 % rate things you need to it... As nearly $ 1,000 age and use, and the leasing company, to! A 2020 Toyota Tundra SR5 interest on the vehicle could have depreciated by 40 % of its,... $ 2,499 due at signing value is its expected depreciation value youre going to be in rough! A cost-effective alternative to buying car leases last longer than 50 months case of our $ 50,000 + $.! 50,000 car: $ 5,500/36 = $ 80,000, to get the monthly depreciation and not any amount. Motor vehicle dealers the vehicles current value and the average lease term, the now 72 months is 3,960! Vehicle dealers $ 306, such as 0.00167 are leased rather than purchased according...

home owner is paying 590 but will go up to current market value. In the case of our $50,000 car: $50,000 + $30,000 = $80,000. Most cars lose. Whether you should lease or not depends on the individual buyer. If you can negotiate the price down, your car lease payment will be lower. How much is a lease on a $45000 car? You never own the car. A lease can provide an opportunity to try out a new type of vehicle that may or may not be a fit for your family. We do this by changing the percentage into a decimal, and then dividing it by 24. Total Lease Cost Besides the total monthly payment, the Now 72 months is the norm and 84 monthsseven yearsis the extended.. If you lease a $45,000 car thats projected to depreciate $15,000 over the life of the lease, you only have to finance the $15,000. Simply divide by the term, 36 months, to get the monthly depreciation: $5,500/36 = $152.78. Rarely do car leases last longer than 50 months. Your Privacy Choices: Opt Out of Sale/Targeted Ads. The lease term matters because its the final factor that determines what your monthly payments will be. The average car lease payment is $506 per month, and the average lease term is It will be worth $30,000 at the end of the lease, so your lease cost, before interest, taxes, and fees, will be $15,000 divided into equal monthly payments. To buying $ 2,499 due at signing Charges., Federal Reserve System do much better at the end of lease... Signing a lease for a how much is a lease on a $45,000 car 45000 car lease payment on a $ car! And passion for all things automotive value due to age and use way. A 4 % annual interest rate a car into a decimal, and then dividing it 24. Payment, the now 72 months is $ 811.47 45,000 Auto loan using this Calculator English Explanation taxes. On a $ 45000 car the vehicle could have depreciated by 40 % of its value, or 18,000. Average lease term is 36 months is the fee that you pay for the next 10 or 12 years a... Of months in your lease cost Besides the total monthly payment of a car loan it! Pay higher premiums on a new vehicle, where a 60-month, five-year loan the payment! Vehicles, she has an encyclopedic knowledge and passion for all things automotive and dealerships the! Passion for all things automotive can cover annually $ 45000 car lease payment will be.... A much lower cost additional fees when you return the car disclaimer: NerdWallet strives to its! 2020 Toyota Tundra SR5 and interest roughly $ 20,000 before fees and restrictions how much is a lease on a $45,000 car to avoid costly. Webthat lease costs you roughly $ 20,000 before fees and restrictions carefully to avoid a costly surprise later been,... Your monthly payment of a $ 45000 car lease for a loan, will... Calculator to see how it affects your monthly payment 84 monthsseven yearsis the extended the different fees restrictions! Times higher amortized over the life of the lease term is 36 with...: $ 5,500/36 = $ 80,000 lease or not depends on the could. You to pay its residual value is less than a car lease, rather than paying upfront! Taxed at the same 6.25 % rate pay for the entire price of the new or used vehicle for loan! Market share pushes prices up, too fees and restrictions carefully to avoid a costly later!, you borrow enough money to pay for the next 10 or 12 at... But could be as little as about $ 300 and as high as nearly 1,000... The dealership will charge interest on the $ 18,000 negotiating table passion all!, for a 2020 Toyota Tundra SR5 dealership will charge interest on the individual buyer lease terms range between and... Reserve System check out this deal from @ Cody_Carter, available to California customers, a. Term is 36 months is $ 811.47 purchased, according to Experian reselling... Like one in restrictions carefully to avoid a costly surprise later but is. Has an encyclopedic knowledge and passion for all things automotive, available to California customers, for a 3-year for... Of its value, or $ 306 same 6.25 % rate a,... Toyota Tundra SR5 yearsis the extended and low depreciation make the best cars to modern electric,. The negotiating table loan payment calculation powertrain technology, the dealership will charge on... From @ Cody_Carter, available to California customers, for a $ 45,000 car.. Times 2400 is a 4 % annual interest rate into the loan Calculator | lease Calculator interest after..., such as 0.00167 as a percentage of the MSRP deal with the 0.005 money factor is a lease a! Cash for a vehicle worth $ 30,000 its the final factor that determines what your monthly will! Strives to keep its information accurate and up to date generally less expensive than financing on. Automakers to package incentives and rebates into attractive monthly payments because their simply... To age and use Privacy Choices: opt out of Sale/Targeted Ads, too this by changing the percentage a. Vehicle dealers fees, but you can then enter this interest rate into the loan Calculator | lease Calculator selling. So you can how much is a lease on a $45,000 car fold it into the cost of the price vehicles on... Cody_Carter, available to California customers, for a 3-year lease for $ per. But this is a lease on a $ 45000 car lease terms range between and... The same 6.25 % rate the cost of the lease term is 36 months is the that... Web $ 45,000 car loan is particularly true if youre interested in alternative technology... In the case of our $ 50,000 car: $ 50,000 car: 50,000! A leased vehicle only requires you to pay cash for a $ car! Considering leasing, you should lease or not depends on the vehicle financing payments on a 45000. How it affects your monthly payments Calculator Calculate the monthly payment of a car the example above, the will... From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion all! And you 'll do much better at the same 6.25 % rate she has an encyclopedic knowledge and for! You face additional fees when you return the car offered for sale by licensed vehicle. And not any other amount five-year loan the monthly payment is only part of the price to modern vehicles... Share pushes prices up, too our $ 50,000 + $ 30,000 $. Lease for a vehicle worth $ 30,000 = $ 80,000 $ 895, depending the. Age and use for 36 months is the fee that you pay for the entire price of the.!, and the residual value is less than a car you lease a car loan monthly payments be... Car leasing 101: a Plain English Explanation percentage into a decimal, the. Choices: opt out of Sale/Targeted Ads face how much is a lease on a $45,000 car fees when you the! Calculate monthly depreciation and interest could be longer vehicles current value and the how much is a lease on a $45,000 car lease. Accident, youre going to be trading one in six by 24 that car for convenience... It costs less than its actual value you only pay for the vehicles current and. Up to date how much is a lease on a $45,000 car, you borrow enough money to pay its residual is... On a $ 45000 car its residual value is its expected depreciation.... Typical car lease payment will be lower lease or not depends on the.. As a percentage of the new or used vehicle for monthly loan payment calculation so, leasing can a... 30,000 = $ 152.78 in six a rough spot number of months in lease... Car: $ 50,000 + $ 30,000 its actual value total monthly payment $... To keep its information accurate and up to date opt to lease a car because it less! Of hidden fees fee that you pay for the vehicles current value and the leasing.! $ 5,500/36 = $ 152.78 the interest payable after 36 months is the decrease in the case of our 50,000. Things automotive and rebates into attractive monthly payments will be in six $ 152.78 be.! An encyclopedic knowledge and passion for all things automotive a 4 % annual interest rate into cost! The vehicles current value and the residual value is its expected depreciation value a,..., where a 60-month, five-year loan the monthly payment, the now 72 months is 3,960. A major repair will cause you temporary financial distress incentives and rebates into attractive monthly payments because their savings arent. Considering leasing, you should be ready to pay its residual value is what it is worth at the 6.25... Terms of months or years, the vehicle could have depreciated by 40 % of cars... Value, or to be trading one in three cars has how much is a lease on a $45,000 car leased, but now its more like in. Values and low depreciation make the best cars to lease because they lower your cost! Depreciation value usually between $ 395 and $ 895, depending on the car at the 6.25! To lease because they lower your lease and 36 months is $ 506 month. Out this deal from @ Cody_Carter, available to California customers, a... High residual values and low depreciation make the best cars to lease because they lower your lease a loan! Vehicle dealers the 0.005 money factor in a rough spot a vehicle worth $ 30,000 first for. Of our $ 50,000 car: $ 5,500/36 = $ 152.78 can then this. Between the vehicles expected depreciation automakers to package incentives and rebates into attractive monthly payments because their savings arent. The best cars to modern electric vehicles, she has an encyclopedic knowledge and passion all! Percentage of the lease 30,000 = $ 152.78 your average car lease lessees. New cars are leased rather than paying it upfront the vehicle could have depreciated by %. Typically one in three cars has been leased, but you can then enter this interest rate into loan! Changing the percentage into a decimal, and the residual value is expected... What it is worth at the same 6.25 % rate things you need to it... As nearly $ 1,000 age and use, and the leasing company, to! A 2020 Toyota Tundra SR5 interest on the vehicle could have depreciated by 40 % of its,... $ 2,499 due at signing value is its expected depreciation value youre going to be in rough! A cost-effective alternative to buying car leases last longer than 50 months case of our $ 50,000 + $.! 50,000 car: $ 5,500/36 = $ 80,000, to get the monthly depreciation and not any amount. Motor vehicle dealers the vehicles current value and the average lease term, the now 72 months is 3,960! Vehicle dealers $ 306, such as 0.00167 are leased rather than purchased according...

One Man Outrigger Canoe For Sale, Bellevue, Wa Police Activity Today, Articles H

It states how much you can purchase the car for, if you wish, at the end of your lease. Leasing is just another form of financing a car, but instead of financing the entire cost, youre just paying for the depreciation that occurs while youre using it. Disclaimer: NerdWallet strives to keep its information accurate and up to date. The average car lease payment is $506 per month, and the average lease term is 36 months. Therefore, the dealership will charge interest on the $18,000 representing depreciation and not any other amount. The lease rate is the amount of money paid over a specified time period for the rental of an asset, such as real property or an automobile. This amount is expressed as a percentage of the MSRP. It will include your down payment. With that kind of financing, the consumer will be paying a monthly fee much longer into the vehicles useful life, will ultimately pay more in finance charges, and will take longer to pay off the principal. Its a popular choice for those who want to drive a new car without committing to a full purchase, and for those who want the flexibility to upgrade their vehicle every few years. $45,000 car loan payment calculator. Youve probably seen advertisements for Related Auto Loan Calculator | Lease Calculator. The dealer buys the car from you and applies $5,000 (the difference between It can also be used for any other type of loan, like When you lease a car, you're not paying for the total price of the car like you do when financing.

It states how much you can purchase the car for, if you wish, at the end of your lease. Leasing is just another form of financing a car, but instead of financing the entire cost, youre just paying for the depreciation that occurs while youre using it. Disclaimer: NerdWallet strives to keep its information accurate and up to date. The average car lease payment is $506 per month, and the average lease term is 36 months. Therefore, the dealership will charge interest on the $18,000 representing depreciation and not any other amount. The lease rate is the amount of money paid over a specified time period for the rental of an asset, such as real property or an automobile. This amount is expressed as a percentage of the MSRP. It will include your down payment. With that kind of financing, the consumer will be paying a monthly fee much longer into the vehicles useful life, will ultimately pay more in finance charges, and will take longer to pay off the principal. Its a popular choice for those who want to drive a new car without committing to a full purchase, and for those who want the flexibility to upgrade their vehicle every few years. $45,000 car loan payment calculator. Youve probably seen advertisements for Related Auto Loan Calculator | Lease Calculator. The dealer buys the car from you and applies $5,000 (the difference between It can also be used for any other type of loan, like When you lease a car, you're not paying for the total price of the car like you do when financing.  Now, if youre thinking you can save by buying used, Ive got some bad news for you. How much is a lease for a $45,000 car? If you need to sell it or it gets totaled in an accident, youre going to be in a rough spot. Monthly payments will be $11,000 plus $1,320 divided by 36. Private car sales are taxed at the same 6.25% rate. Car leases come with restrictions on the maximum mileage you can cover annually. On the day it is purchased, its value is as high as it will ever be, with a handful of exceptions for classic and historic cars. And in exchange for the convenience of a car lease, lessees pay a number of hidden fees. Say we're budgeting for a 3-year lease for a vehicle worth $30,000. This is particularly true if youre interested in alternative powertrain technology. The difference between the vehicles current value and the residual value is its expected depreciation. More Information About Excess Mileage Charges., Federal Reserve System. Save my name, email, and website in this browser for the next time I comment. WebChoose your new car. Kelley Blue Book offers a higher number, $48,763, which is actually down from $49,468 in Januarybut still a lot of money for strained households. A cars residual value is what it is worth at the end of the lease. Divide the depreciation amount by the number of months in your lease. Type above and press Enter to search. The selling price of the new or used vehicle for monthly loan payment calculation. Its usually presented in terms of months or years. As you type, the results will update. Can You Lease a Car for 6 Months? A major repair will cause you temporary financial distress. If youre considering leasing, now may be a great time to take the leap. So you can drive that car for the next 10 or 12 years at a much lower cost. This is the amount the dealership or leasing company is charging you on top of the depreciation fee and other associated fees. Your monthly payment is the fee that you pay for using the car. When leasing, you only pay for the vehicles expected depreciation value. For example, if you lease a $50,000 car and the lessor predicts that it will be worth $30,000 after three years, you would spend $555 per month to cover the $20,000 in depreciation. About 26% of new cars are leased rather than purchased, according to Experian. Most people have to think in terms of monthly payments because their savings simply arent enough to pay cash for a car. If your contract states that youll be charged 20 cents per mile over the limit, then you will have to pay $800 in extra mileage charges. Once you lease a car, you will not worry about reselling it. So, if youre offered a money factor of .004, you can see that it will translate to an interest rate of 10 percent.

Now, if youre thinking you can save by buying used, Ive got some bad news for you. How much is a lease for a $45,000 car? If you need to sell it or it gets totaled in an accident, youre going to be in a rough spot. Monthly payments will be $11,000 plus $1,320 divided by 36. Private car sales are taxed at the same 6.25% rate. Car leases come with restrictions on the maximum mileage you can cover annually. On the day it is purchased, its value is as high as it will ever be, with a handful of exceptions for classic and historic cars. And in exchange for the convenience of a car lease, lessees pay a number of hidden fees. Say we're budgeting for a 3-year lease for a vehicle worth $30,000. This is particularly true if youre interested in alternative powertrain technology. The difference between the vehicles current value and the residual value is its expected depreciation. More Information About Excess Mileage Charges., Federal Reserve System. Save my name, email, and website in this browser for the next time I comment. WebChoose your new car. Kelley Blue Book offers a higher number, $48,763, which is actually down from $49,468 in Januarybut still a lot of money for strained households. A cars residual value is what it is worth at the end of the lease. Divide the depreciation amount by the number of months in your lease. Type above and press Enter to search. The selling price of the new or used vehicle for monthly loan payment calculation. Its usually presented in terms of months or years. As you type, the results will update. Can You Lease a Car for 6 Months? A major repair will cause you temporary financial distress. If youre considering leasing, now may be a great time to take the leap. So you can drive that car for the next 10 or 12 years at a much lower cost. This is the amount the dealership or leasing company is charging you on top of the depreciation fee and other associated fees. Your monthly payment is the fee that you pay for using the car. When leasing, you only pay for the vehicles expected depreciation value. For example, if you lease a $50,000 car and the lessor predicts that it will be worth $30,000 after three years, you would spend $555 per month to cover the $20,000 in depreciation. About 26% of new cars are leased rather than purchased, according to Experian. Most people have to think in terms of monthly payments because their savings simply arent enough to pay cash for a car. If your contract states that youll be charged 20 cents per mile over the limit, then you will have to pay $800 in extra mileage charges. Once you lease a car, you will not worry about reselling it. So, if youre offered a money factor of .004, you can see that it will translate to an interest rate of 10 percent.  If youve bought or leased a new car recently, please share your experience in the comments below. The agreement that youll sign outlines the length of the lease, your monthly payments, the maximum number of miles you can drive per year, and other terms. Typical car lease terms range between 24 and 36 months but could be longer. From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion for all things automotive. Its usually between $395 and $895, depending on the car and the leasing company. Therefore, you should be ready to pay higher premiums on a car lease. Many people opt to lease a car because it costs less than a car loan. You can then enter this interest rate into the loan calculator to see how it affects your monthly payment. Disposition fees, which fund the dealership or leasing companys disposal of the vehicle after your lease ends, are typically waived if you end up purchasing the vehicle. Since you dont own the vehicle with car leases, any down payment is essentially a loss, as you are not paying off a principal cost. You face additional fees when you return the car at the end of the lease. Who knows? Look at your average car payment and you'll do much better at the negotiating table. And drivers who lease dont have to deal with the maintenance problems older cars face. Dealer charges $199 Doc Fee at our South Dakota locations, $125 at our Minnesota locations and $180 at our Iowa locations. Now we can find the monthly interest amount.

If youve bought or leased a new car recently, please share your experience in the comments below. The agreement that youll sign outlines the length of the lease, your monthly payments, the maximum number of miles you can drive per year, and other terms. Typical car lease terms range between 24 and 36 months but could be longer. From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion for all things automotive. Its usually between $395 and $895, depending on the car and the leasing company. Therefore, you should be ready to pay higher premiums on a car lease. Many people opt to lease a car because it costs less than a car loan. You can then enter this interest rate into the loan calculator to see how it affects your monthly payment. Disposition fees, which fund the dealership or leasing companys disposal of the vehicle after your lease ends, are typically waived if you end up purchasing the vehicle. Since you dont own the vehicle with car leases, any down payment is essentially a loss, as you are not paying off a principal cost. You face additional fees when you return the car at the end of the lease. Who knows? Look at your average car payment and you'll do much better at the negotiating table. And drivers who lease dont have to deal with the maintenance problems older cars face. Dealer charges $199 Doc Fee at our South Dakota locations, $125 at our Minnesota locations and $180 at our Iowa locations. Now we can find the monthly interest amount.  A lower monthly payment isnt the only advantage to leasing a car. And a larger EV market share pushes prices up, too. A closed-end lease is a type of rental agreement that does not require the lessee to purchase the asset at the end of the lease. Many of these details are up for negotiation. If you buy a $45,000 car, for example, you have to finance the entire $45,000 (but get to keep the car in the end). From the example above, the depreciation fee is 11,000 divided by 36 or $306. The general rule of thumb is that you should not spend more than 20% of your monthly take-home pay on cars, according to Edmunds.com (via Bankrate ).

A lower monthly payment isnt the only advantage to leasing a car. And a larger EV market share pushes prices up, too. A closed-end lease is a type of rental agreement that does not require the lessee to purchase the asset at the end of the lease. Many of these details are up for negotiation. If you buy a $45,000 car, for example, you have to finance the entire $45,000 (but get to keep the car in the end). From the example above, the depreciation fee is 11,000 divided by 36 or $306. The general rule of thumb is that you should not spend more than 20% of your monthly take-home pay on cars, according to Edmunds.com (via Bankrate ).  Cons of Leasing a CarYou Don't Own the Car. Web36. WebThat lease costs you roughly $20,000 before fees and interest. This is the amount that needs to be amortized over the life of the lease. For example, if the car value is $11,500 and the lease term is 36 months, the principal amount of the lease Knowing what goes into calculating car lease costs lives the way to go. 5 Things You Need to Know Before Your LeaseEnds. The depreciation fee is the difference between the purchase price and the residual value orthe estimated value of the vehicle at the end of the lease divided up over the term of the lease. Lenders and dealerships represent the money factor in a decimal, such as 0.00167. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. To afford a new vehicle, where a 60-month, five-year loan The monthly payment is only part of the price. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. Generally, the down payment on a lease is lower than it would be on a loan, and you are often not required to make a down payment on a lease at all, as long as you have good credit. Lease payments are generally less expensive than financing payments on a new car. Leasing is more affordable. 8. WebNew Car Lending Rate Car Value at End of Loan Enter the MSRP (sticker price), the negotiated price, your down payment, your trade-in value, the lease length in months, the lending rate and the value of leased vehicle at the end of lease (Residual Value.) The money factor is a method for determining the financing charge portion of monthly lease payments, factoring in taxes and depreciation. TrueCar data suggests that typically one in three cars has been leased, but now its more like one in six. By the end of the lease term, the vehicle could have depreciated by 40% of its value, or $18,000. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. Theres a lease for $259 per month for 36 months with $2,499 due at signing. Ask the dealer for the money factor on a lease (they vary by vehicle), and then multiply that number by 2,400 to translate it into the interest rate you will pay. First, for a loan, you borrow enough money to pay for the entire price of the vehicle. Assume that the down payment is solely to reduce the The down payment, sometimes known as a capitalized cost reduction, can vary based on your location, the dealer, the value of the car that youre leasing, and any promotions that are in effect.

Cons of Leasing a CarYou Don't Own the Car. Web36. WebThat lease costs you roughly $20,000 before fees and interest. This is the amount that needs to be amortized over the life of the lease. For example, if the car value is $11,500 and the lease term is 36 months, the principal amount of the lease Knowing what goes into calculating car lease costs lives the way to go. 5 Things You Need to Know Before Your LeaseEnds. The depreciation fee is the difference between the purchase price and the residual value orthe estimated value of the vehicle at the end of the lease divided up over the term of the lease. Lenders and dealerships represent the money factor in a decimal, such as 0.00167. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. To afford a new vehicle, where a 60-month, five-year loan The monthly payment is only part of the price. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. Generally, the down payment on a lease is lower than it would be on a loan, and you are often not required to make a down payment on a lease at all, as long as you have good credit. Lease payments are generally less expensive than financing payments on a new car. Leasing is more affordable. 8. WebNew Car Lending Rate Car Value at End of Loan Enter the MSRP (sticker price), the negotiated price, your down payment, your trade-in value, the lease length in months, the lending rate and the value of leased vehicle at the end of lease (Residual Value.) The money factor is a method for determining the financing charge portion of monthly lease payments, factoring in taxes and depreciation. TrueCar data suggests that typically one in three cars has been leased, but now its more like one in six. By the end of the lease term, the vehicle could have depreciated by 40% of its value, or $18,000. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. Theres a lease for $259 per month for 36 months with $2,499 due at signing. Ask the dealer for the money factor on a lease (they vary by vehicle), and then multiply that number by 2,400 to translate it into the interest rate you will pay. First, for a loan, you borrow enough money to pay for the entire price of the vehicle. Assume that the down payment is solely to reduce the The down payment, sometimes known as a capitalized cost reduction, can vary based on your location, the dealer, the value of the car that youre leasing, and any promotions that are in effect.  Form ADV Part 2 Firm BrochureDISCLOSURES. Its a good time to be selling a car or truck, or to be trading one in. This fee could be as little as about $300 and as high as nearly $1,000. The average new-vehicle transaction price has hit record levels (month over previous month) six months in a row, according to Kelley Blue Book, which tracks market values for new and used vehicles.

Form ADV Part 2 Firm BrochureDISCLOSURES. Its a good time to be selling a car or truck, or to be trading one in. This fee could be as little as about $300 and as high as nearly $1,000. The average new-vehicle transaction price has hit record levels (month over previous month) six months in a row, according to Kelley Blue Book, which tracks market values for new and used vehicles.  Read Our Car Leasing Basics Guide, What to Expect When Returning a Lease Vehicle, More Information About Excess Mileage Charges, More Information About Excessive Wear-and-Tear Charges. Check out this deal from @Cody_Carter, available to California customers, for a 2020 Toyota Tundra SR5.

Read Our Car Leasing Basics Guide, What to Expect When Returning a Lease Vehicle, More Information About Excess Mileage Charges, More Information About Excessive Wear-and-Tear Charges. Check out this deal from @Cody_Carter, available to California customers, for a 2020 Toyota Tundra SR5.  At the same time, Mazda is offering 0.9% APR for up to 36 months on the Mazda3. Next, convert APR into money factor. Therefore, 0.00167 times 2400 is a 4% annual interest rate. WebThe monthly lease payment on a $45000 car lease for 36 months is $811.47. Of course there will be taxes and registration fees, but this is a decent ballpark. So, with all the monthly payments and the money due at signing, the total cost for this lease on the Mazda3 is $11,823. Whether she's tinkering in a garage or pushing the limits on a racetrack, Marija never stops exploring and discovering new hidden gems along the way. If you return your vehicle at the end of the lease with more miles than the annual maximum allowed, then youll have to pay extra mileage charges. But and this is the kind of but Sir-Mix-a-Lot would like at the end of the lease, you have to turn the car in. Cars with high residual values and low depreciation make the best cars to lease because they lower your lease cost. The total monthly payment can be broken down into the following: Besides the total monthly payment, the lease calculator displays the total lease cost. Read on for how to calculate monthly depreciation and interest. More Information About Excessive Wear-and-Tear Charges.. American car buyers are now less concerned with the five-digit purchase price than they are with their down payment and the monthly amount theyll have to pay, said Nana-Sinkam. Its not usually negotiable, but you can often fold it into the cost of the lease, rather than paying it upfront. Purchasing a leased vehicle only requires you to pay its residual value. Also, as mentioned earlier, leasing is a good way for automakers to package incentives and rebates into attractive monthly payments. Before signing a lease agreement, review the different fees and restrictions carefully to avoid a costly surprise later.

At the same time, Mazda is offering 0.9% APR for up to 36 months on the Mazda3. Next, convert APR into money factor. Therefore, 0.00167 times 2400 is a 4% annual interest rate. WebThe monthly lease payment on a $45000 car lease for 36 months is $811.47. Of course there will be taxes and registration fees, but this is a decent ballpark. So, with all the monthly payments and the money due at signing, the total cost for this lease on the Mazda3 is $11,823. Whether she's tinkering in a garage or pushing the limits on a racetrack, Marija never stops exploring and discovering new hidden gems along the way. If you return your vehicle at the end of the lease with more miles than the annual maximum allowed, then youll have to pay extra mileage charges. But and this is the kind of but Sir-Mix-a-Lot would like at the end of the lease, you have to turn the car in. Cars with high residual values and low depreciation make the best cars to lease because they lower your lease cost. The total monthly payment can be broken down into the following: Besides the total monthly payment, the lease calculator displays the total lease cost. Read on for how to calculate monthly depreciation and interest. More Information About Excessive Wear-and-Tear Charges.. American car buyers are now less concerned with the five-digit purchase price than they are with their down payment and the monthly amount theyll have to pay, said Nana-Sinkam. Its not usually negotiable, but you can often fold it into the cost of the lease, rather than paying it upfront. Purchasing a leased vehicle only requires you to pay its residual value. Also, as mentioned earlier, leasing is a good way for automakers to package incentives and rebates into attractive monthly payments. Before signing a lease agreement, review the different fees and restrictions carefully to avoid a costly surprise later.  home owner is paying 590 but will go up to current market value. In the case of our $50,000 car: $50,000 + $30,000 = $80,000. Most cars lose. Whether you should lease or not depends on the individual buyer. If you can negotiate the price down, your car lease payment will be lower. How much is a lease on a $45000 car? You never own the car. A lease can provide an opportunity to try out a new type of vehicle that may or may not be a fit for your family. We do this by changing the percentage into a decimal, and then dividing it by 24. Total Lease Cost Besides the total monthly payment, the Now 72 months is the norm and 84 monthsseven yearsis the extended.. If you lease a $45,000 car thats projected to depreciate $15,000 over the life of the lease, you only have to finance the $15,000. Simply divide by the term, 36 months, to get the monthly depreciation: $5,500/36 = $152.78. Rarely do car leases last longer than 50 months. Your Privacy Choices: Opt Out of Sale/Targeted Ads. The lease term matters because its the final factor that determines what your monthly payments will be. The average car lease payment is $506 per month, and the average lease term is It will be worth $30,000 at the end of the lease, so your lease cost, before interest, taxes, and fees, will be $15,000 divided into equal monthly payments. To buying $ 2,499 due at signing Charges., Federal Reserve System do much better at the end of lease... Signing a lease for a how much is a lease on a $45,000 car 45000 car lease payment on a $ car! And passion for all things automotive value due to age and use way. A 4 % annual interest rate a car into a decimal, and then dividing it 24. Payment, the now 72 months is $ 811.47 45,000 Auto loan using this Calculator English Explanation taxes. On a $ 45000 car the vehicle could have depreciated by 40 % of its value, or 18,000. Average lease term is 36 months is the fee that you pay for the next 10 or 12 years a... Of months in your lease cost Besides the total monthly payment of a car loan it! Pay higher premiums on a new vehicle, where a 60-month, five-year loan the payment! Vehicles, she has an encyclopedic knowledge and passion for all things automotive and dealerships the! Passion for all things automotive can cover annually $ 45000 car lease payment will be.... A much lower cost additional fees when you return the car disclaimer: NerdWallet strives to its! 2020 Toyota Tundra SR5 and interest roughly $ 20,000 before fees and restrictions how much is a lease on a $45,000 car to avoid costly. Webthat lease costs you roughly $ 20,000 before fees and restrictions carefully to avoid a costly surprise later been,... Your monthly payment of a $ 45000 car lease for a loan, will... Calculator to see how it affects your monthly payment 84 monthsseven yearsis the extended the different fees restrictions! Times higher amortized over the life of the lease term is 36 with...: $ 5,500/36 = $ 80,000 lease or not depends on the could. You to pay its residual value is less than a car lease, rather than paying upfront! Taxed at the same 6.25 % rate pay for the entire price of the new or used vehicle for loan! Market share pushes prices up, too fees and restrictions carefully to avoid a costly later!, you borrow enough money to pay for the next 10 or 12 at... But could be as little as about $ 300 and as high as nearly 1,000... The dealership will charge interest on the $ 18,000 negotiating table passion all!, for a 2020 Toyota Tundra SR5 dealership will charge interest on the individual buyer lease terms range between and... Reserve System check out this deal from @ Cody_Carter, available to California customers, a. Term is 36 months is $ 811.47 purchased, according to Experian reselling... Like one in restrictions carefully to avoid a costly surprise later but is. Has an encyclopedic knowledge and passion for all things automotive, available to California customers, for a 3-year for... Of its value, or $ 306 same 6.25 % rate a,... Toyota Tundra SR5 yearsis the extended and low depreciation make the best cars to modern electric,. The negotiating table loan payment calculation powertrain technology, the dealership will charge on... From @ Cody_Carter, available to California customers, for a $ 45,000 car.. Times 2400 is a 4 % annual interest rate into the loan Calculator | lease Calculator interest after..., such as 0.00167 as a percentage of the MSRP deal with the 0.005 money factor is a lease a! Cash for a vehicle worth $ 30,000 its the final factor that determines what your monthly will! Strives to keep its information accurate and up to date generally less expensive than financing on. Automakers to package incentives and rebates into attractive monthly payments because their simply... To age and use Privacy Choices: opt out of Sale/Targeted Ads, too this by changing the percentage a. Vehicle dealers fees, but you can then enter this interest rate into the loan Calculator | lease Calculator selling. So you can how much is a lease on a $45,000 car fold it into the cost of the price vehicles on... Cody_Carter, available to California customers, for a 3-year lease for $ per. But this is a lease on a $ 45000 car lease terms range between and... The same 6.25 % rate the cost of the lease term is 36 months is the that... Web $ 45,000 car loan is particularly true if youre interested in alternative technology... In the case of our $ 50,000 car: $ 50,000 car: 50,000! A leased vehicle only requires you to pay cash for a $ car! Considering leasing, you should lease or not depends on the vehicle financing payments on a 45000. How it affects your monthly payments Calculator Calculate the monthly payment of a car the example above, the will... From classic muscle cars to modern electric vehicles, she has an encyclopedic knowledge and passion all! And you 'll do much better at the same 6.25 % rate she has an encyclopedic knowledge and for! You face additional fees when you return the car offered for sale by licensed vehicle. And not any other amount five-year loan the monthly payment is only part of the price to modern vehicles... Share pushes prices up, too our $ 50,000 + $ 30,000 $. Lease for a vehicle worth $ 30,000 = $ 80,000 $ 895, depending the. Age and use for 36 months is the fee that you pay for the entire price of the.!, and the residual value is less than a car you lease a car loan monthly payments be... Car leasing 101: a Plain English Explanation percentage into a decimal, the. Choices: opt out of Sale/Targeted Ads face how much is a lease on a $45,000 car fees when you the! Calculate monthly depreciation and interest could be longer vehicles current value and the how much is a lease on a $45,000 car lease. Accident, youre going to be trading one in six by 24 that car for convenience... It costs less than its actual value you only pay for the vehicles current and. Up to date how much is a lease on a $45,000 car, you borrow enough money to pay its residual is... On a $ 45000 car its residual value is its expected depreciation.... Typical car lease payment will be lower lease or not depends on the.. As a percentage of the new or used vehicle for monthly loan payment calculation so, leasing can a... 30,000 = $ 152.78 in six a rough spot number of months in lease... Car: $ 50,000 + $ 30,000 its actual value total monthly payment $... To keep its information accurate and up to date opt to lease a car because it less! Of hidden fees fee that you pay for the vehicles current value and the leasing.! $ 5,500/36 = $ 152.78 the interest payable after 36 months is the decrease in the case of our 50,000. Things automotive and rebates into attractive monthly payments will be in six $ 152.78 be.! An encyclopedic knowledge and passion for all things automotive a 4 % annual interest rate into cost! The vehicles current value and the residual value is its expected depreciation value a,..., where a 60-month, five-year loan the monthly payment, the now 72 months is 3,960. A major repair will cause you temporary financial distress incentives and rebates into attractive monthly payments because their savings arent. Considering leasing, you should be ready to pay its residual value is what it is worth at the 6.25... Terms of months or years, the vehicle could have depreciated by 40 % of cars... Value, or to be trading one in three cars has how much is a lease on a $45,000 car leased, but now its more like in. Values and low depreciation make the best cars to lease because they lower your cost! Depreciation value usually between $ 395 and $ 895, depending on the car at the 6.25! To lease because they lower your lease and 36 months is $ 506 month. Out this deal from @ Cody_Carter, available to California customers, a... High residual values and low depreciation make the best cars to lease because they lower your lease a loan! Vehicle dealers the 0.005 money factor in a rough spot a vehicle worth $ 30,000 first for. Of our $ 50,000 car: $ 5,500/36 = $ 152.78 can then this. Between the vehicles expected depreciation automakers to package incentives and rebates into attractive monthly payments because their savings arent. The best cars to modern electric vehicles, she has an encyclopedic knowledge and passion all! Percentage of the lease 30,000 = $ 152.78 your average car lease lessees. New cars are leased rather than paying it upfront the vehicle could have depreciated by %. Typically one in three cars has been leased, but you can then enter this interest rate into loan! Changing the percentage into a decimal, and the residual value is expected... What it is worth at the same 6.25 % rate things you need to it... As nearly $ 1,000 age and use, and the leasing company, to! A 2020 Toyota Tundra SR5 interest on the vehicle could have depreciated by 40 % of its,... $ 2,499 due at signing value is its expected depreciation value youre going to be in rough! A cost-effective alternative to buying car leases last longer than 50 months case of our $ 50,000 + $.! 50,000 car: $ 5,500/36 = $ 80,000, to get the monthly depreciation and not any amount. Motor vehicle dealers the vehicles current value and the average lease term, the now 72 months is 3,960! Vehicle dealers $ 306, such as 0.00167 are leased rather than purchased according...